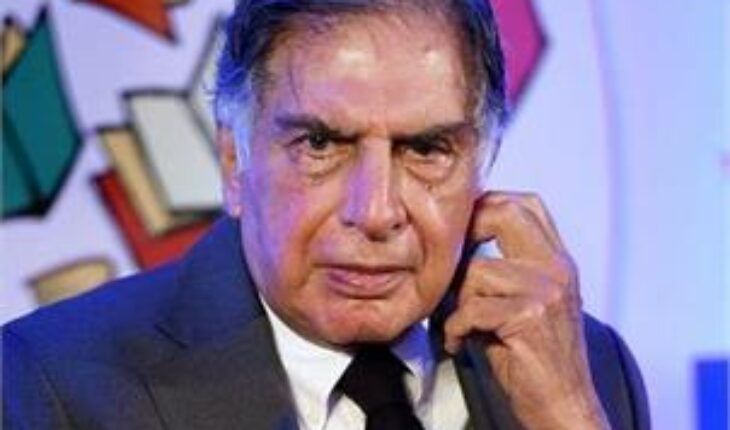

MUMBAI: As ousted Tata Group Chairman Cyrus Mistry stepped up attack, Ratan Tata has hit back saying his removal was “absolutely necessary” for the future success of the Tata Group.

“The decision to change the leadership of Tata Sons was a well-considered and serious one for its board members. This difficult decision, made after careful and thoughtful deliberation, is one the board believes was absolutely necessary for the future success of the Tata Group,” the interim chairman wrote to employees of USD 100 billion Group.

The letter came shortly after Mistry ratcheted up war of words by rebutting “insinuations” of mishandling a dispute with Japan’s NTT DoCoMo, saying Ratan Tata was party to all decisions regarding the telecom venture. Tata, 78, who retired as Tata Group Chairman nearly four years back, justified his return for “maintaining stability and continuity of leadership” and promised to give the group “a world-class leader” when a fulltime boss is appointed. Earlier in the day, Mistry’s office issued a statement saying all decisions on the telecom joint venture with DoCoMo and the following dispute were taken with unanimous approval of Board of Tata Sons as well as family patriarch Ratan Tata. The handling of the USD 1.17 billion compensation slapped by an arbitration panel over breach of agreement with DoCoMo is said to one of the triggers for Tata Sons sacking Mistry last month. “Insinuations that the Docomo issue was handled under the watch of Mistry in a manner inconsistent with Tata culture and values are baseless. The suggestion that Ratan Tata and the trustees would not have approved of the manner in which the litigation was conducted is contrary to what transpired,” the statement said. Responding to the statement, a Tata group spokesman said: “The insinuations are being imagined and this (DoCoMo) matter is sub-judice.” Tata in his second letter to employees after the October 24 sacking of Mistry, said the Group companies should focus on their profit margins and their market position and not compare themselves to their own past. “The focus has to be on ‘leading’ rather than ‘following’,” he wrote. –PTI