By Dominick Rodrigues

Mumbai : Anupam Rasayan India Limited, a Surat-based, custom synthesis and manufacturing focused specialty chemicals company, announced here today their Initial Public Offering (IPO) — of equity shares at Rs 553 to Rs 555 per share aggregating Rs 760 crores — from March 12, 2021 to March 16, 2021.

The Company proposes to utilise the Net Proceeds of the IPO – which comprises of a complete fresh issuance of Equity Shares and will be listed on BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”).– towards repayment/prepayment of certain indebtedness availed by the Company and for general corporate purposes.

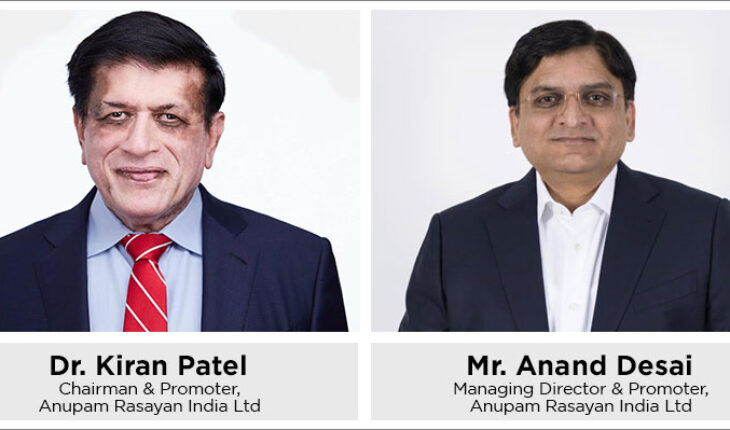

Addressing the media, Anand Desai – Managing Director & Promoter, Anupam Rasayan India Ltd., said the company started in 1984 to become today the sole/primary supplier for companies in Europe and was i9n expansion mode since 2013 with Rs 800 crores investment amidst annual growth of 24% including 45% growth during the pandemic itself.

Afzal Malkani – CFO, Anupam Rasayan India Ltd, said the company is recognized as a 3-star export house and drew its revenue from exports (68%) and domestic business (32%). “We are in Agrochemicals (crop protection), Personal Care and Pharmaceuticals with 90% revenue coming in from LifeSciences. There is significant opportunity for flow chemistry technology in specialty chemicals, specifically pharmaceutical as it reduces cost and leadtime significantly. Photochemical reactions are currently becoming important tool in search of new compounds.”

“The focus is on process innovation through continuous R&D. Indian CRAMS market expected growth is at 12% in the next five years due to strong growth from end-use demand.. Our acquisition opportunities are to selectively expand in other verticals. Our production presently is 23,438 tonnes from the six manufacturing facilities.”

Replying to questions, Malkani said barely 12% of its raw material was imported from China, though procurement was 75% from India and 25% from abroad.

Expressing happiness at being the catalyst and witnessing the beginning of the company’s second Phase of exponential growth, Dr. Kiran Patel – Chairman & Promoter, Anupam Rasayan India Ltd., said lifesciences offered an opportunity to save humanity while observing safety for the ecosystem.

Axis Capital Limited, Ambit Private Limited, IIFL Securities Limited and JM Financial Limited are the book running lead managers to the Issue (“BRLMs”).

Anupam Rasayan is engaged in the custom synthesis and manufacturing of specialty chemicals in India and has two distinct verticals which includes life science related specialty chemicals comprising products related to agrochemicals, personal care and pharmaceuticals; and other specialty chemicals, comprising specialty pigment and dyes, and polymer additives.

The company has developed strong and long-term relationships with various multinational corporations, including Syngenta Asia Pacific Pte. Ltd., Sumitomo Chemical Company Limited and UPL Limited that has helped the Company expand its product offerings and geographic reach across Europe, Japan, United States and India.

As of December 31, 2020, the Company operates through six multi-purpose manufacturing facilities based in Gujarat, India; with four facilities located at Sachin, Surat, Gujarat and two located at Jhagadia, Bharuch, Gujarat.

From FY18 to FY20, the Company’s total revenue increased at a CAGR of 24.29 % and its EBITDA for FY20 stood at Rs 1,348.96 million. Despite the COVID-19 pandemic, the Company’s revenue from operations significantly increased by 45.03% from ₹ 3,718.07 million in the nine months ended December 31, 2019 to ₹ 5,392.20 million in the nine months ended December 31, 2020.

The Company’s key focus is on developing in-house innovative processes for manufacturing products requiring complex chemistries and achieving cost optimization. The Company is also one of the leading companies in manufacturing products using continuous and flow chemistry technology on a commercial scale in India (Source: F&S Report).

The Company believes that their ability to meet stringent quality and technical specifications and customizations, undertake large number of complex chemical reactions and automated manufacturing capabilities, develop in-house innovative processes along with strong technical competencies and R&D capabilities, and transparent cost model, has enabled them to act as a complete one-stop solution for process innovation and development of specialty chemicals for multinational companies in a cost-efficient manner.