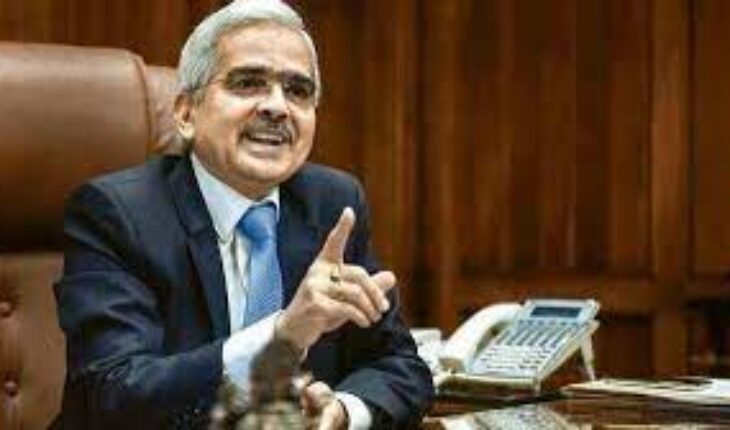

The Reserve Bank of India’s rate decision last Friday was ultimately inevitable. Monetary policymakers were left with little choice but to raise interest rates by 50 basis points, as a bout of extreme volatility in international financial markets combines with persistently high domestic retail inflation to threaten macroeconomic stability, globally and in India. RBI Governor Shaktikanta Das cited the ‘aggressive monetary policy actions and even more aggressive communication from advanced economy central banks’ as a third shock — following the pandemic and Russia’s invasion of Ukraine — which he said had thrust the ‘global economy into the eye of a new storm’. The central bank’s own projections, in fact, do not anticipate a slowing in India’s retail inflation below its upper tolerance threshold of 6% till the January-March quarter. There are multiple factors that could upend the RBI’s inflation outlook. These include the likelihood of higher pass-through of input costs by service providers on increased demand, as well as upside risks to food prices from both the lower kharif output of rice and pulses, and the unseasonably excess spells of rainfall in some regions that have pushed up the prices of vegetables. The surfeit of liquidity or cash in the banking system could also threaten price stability and the RBI Governor was at pains to note that the policy stance of a calibrated ‘withdrawal of accommodation’ had become an imperative. Specifically, he pointed out that ‘even as the nominal policy repo rate had been raised by 190 basis points since May, the rate adjusted for inflation still trailed the 2019 levels’. With the RBI’s latest surveys of households’ inflation expectations and consumer confidence too signalling that price pressures will continue to restrain consumption, inflation control will have to remain the top policy priority.

Inflation control should be top policy priority

Published Date: 07-10-2022 | 6:56 pm