The union government has presented the budget for 2023-24FY during uncertainties in the global economy. The covid-19 pandemic followed by the Ukrainian war has caused an economic slowdown all over the world. Again, the slowdown in growth is accompanied by higher levels of unemployment and price rises owing to supply chain disruptions.

Under this cloud of uncertainty, the union budget has shown adequate courage to prepare a roadmap for sustained growth without compromising fiscal prudence. In its effort, it got support from the current macroeconomic fundamentals of the domestic economy.The economy (GDP at constant prices) is estimated to grow at 7 percent during the current financial year 2022-23. This is a credible estimation looking at the first two quarters’ growth rate of 13.5 percent and 6.3 percent respectively.

For the financial year 2023-24, the budget made a GDP (at current prices) growth estimate of 10.5 percent. However, the economic survey 2022-23 projected a GDP (at constant prices) growth rate of 6.5 percent. This shows that the inflation rate which is the difference between growth at the current and constant prices is expected to remain within the range of 4 percent to 4.5 percent in 2023-24.

Both CPI and WPI inflation are within RBI’s targeting range in 2022-23. According to the latest information from MOSPI, the WPI inflation rate stands at 4.95 percent as of December 31, 2022. The lower WPI inflation generates a positive impact on CPI inflation as a rise in prices at the production stage ultimately passes to the consumer. The CPI inflation has remained all-time low in 2022.The December-end combined CPI inflation rate stands at 5.7 percent. Importantly, the CPI food inflation is at a reasonable limit of 4.2 percent during this time.

The rate of unemployment, another macroeconomic fundamental, has remained within an absorption limit. The urban unemployment rate follows a declining trend since it reached the highest rate of 20.9 percent in June 2020. As per the latest information from MOSPI, the rate reached 7.2 percent as of September 2022. The CMIE data on the monthly unemployment rate supports the lower rate of unemployment. According to the CMIE source, the rural unemployment rate stands at 5.8 percent, and the urban unemployment stands at 8.1 percent as of January 2023.

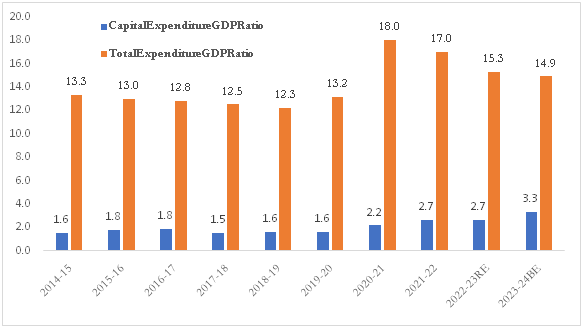

With all favourable macroeconomic conditions in place, the union budget 2023-24 emphasised capital expenditure to make the growth sustainable. Capital expenditure is estimated to rise by 37.4 percent in 2023-24(BE) from its previous year 2022-23(RE). It shares about 22.2 percent of the total union government spending in 2023-24(BE) compared to 11.8 percent in 2014-15. As a share of GDP, capital expenditure increased from 1.3 percent in 2014-15 to 3.3 percent in 2023-24(BE). Capital expenditure helps in capital formation and technology development which contributes to productivity, growth, and employment generation in the long run. According to RBI sources, capital expenditure has a multiplier effect of above 3 on growth compared to less than 1 in revenue expenditure.

Figure. The ratio of Total Expenditure and Capital Expenditure to GDP (%)

The union government’s approach to expenditure policy is responsible. While raising the bar of capital expenditure, it has maintained discipline in fiscal consolidation. The total expenditure of the government is shrinking in size and its ratio to GDP declined from 15.3 percent in 2022-23(RE) to 14.9 percent in 2023-24 (BE).

However, the shrinking budget size is a concern for the social sector spending. A larger share of social sector allocation goes in form of revenue expenditure. In the union budget 2023-24, the central sector and centrally sponsored schemes are the casualties of the shrinking budget size. The central sector schemes expenditure to GDP ratio fell from 5.1 percent in 2022-23(RE) to 4.8 percent in 2023-24(BE). During the same time, the centrally sponsored schemes’ expenditure to GDP ratio declined from 1.65 percent to 1.57 percent.

Maintaining fiscal discipline and the creation of fiscal space are a few of the important aspects of the budget-making process. There is a limit to expenditure as revenue-generating sources are limited. The fiscal deficit to GDP ratio in 2022-23 (RE) has remained the same as per the previous year’s budget estimate of 6.4 percent. For the year 2023-24 (BE), the union government limits it to 5.9 percent. In her budget speech, the finance minister announced to further lowering the fiscal deficit to GDP ratio to 4.5 percent in 2024-25.

The lower level of fiscal deficit generates ample space for the government to safeguard against any uncertainty. However, in the union budget 2023-24 the fiscal space is generated by shrinking the size of the budget as revenue-generating sources are limited. Revenue generation from taxes has not improved despite various reforms. In 2014-15, the tax-to-GDP ratio was 7.2 percent, and it is expected to be 7.7 percent in 2023-24(BE).

Revenue generation from GST, major tax reform in the indirect taxation system has been gaining momentum. In 2023-24(BE), it has overtaken income tax and corporate tax to become the leader among all taxes. However, the GST to GDP ratio stands at 3.1 percent in the last three years.

However, a lack of growth in revenue from income and corporate taxes is a concern. The union budget has laid out a plan for the restructuring of personal income taxes by generating various slabs and sub-slabs. Even with this restructuring, the government is not expecting a higher revenue from personal income taxes. The estimated growth of personal income taxes during 2023-24(BE) is 10 percent which is lower than its previous year’s growth of 17 percent.

Despite various challenges from the revenue front, the union budget 2023-24 has made an exemplary balancing act to steer economic growth under uncertainty without compromising fiscal prudence. It has given a wise response to all uncertainties in a responsible way.

Dr. Sridhar Kundu, Bharti Institute of Public Policy ,Indian School of Business, Mohali, Punjab