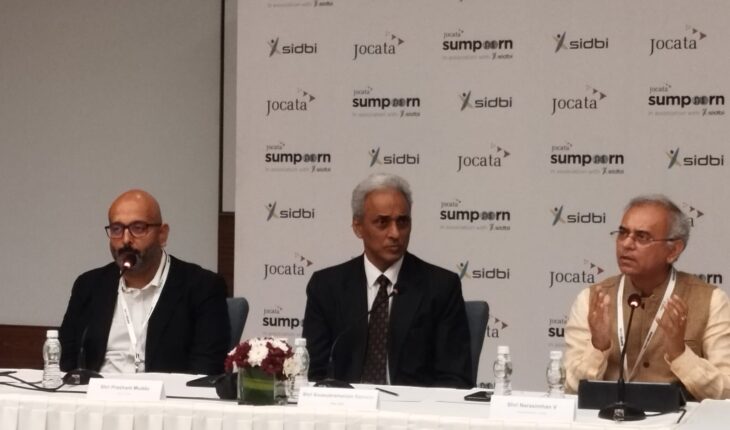

Mumbai: “Sumpoorn” – India’s first MSME Economic Activity Index – was launched here recently by JOCATA and SIDBI to highlight a “consent-based GST sales data Index” that represents a transformative step forward in the evolution of Indian MSMEs.

Sivasubramanian Ramann, CMD, SIDBI, said that though the MSME sector was a significant player in the Indian economy, data paucity in this sector was a challenge for industry members and policymakers, and Sumpoorn would help in measuring ‘transaction health’ of SIDBI’s customers.

“We at SIDBI have been constantly engaged in the development of the MSME sector including through institutions to bridge the information symmetry to enable informed decision-making by stakeholders,” Ramann said, adding that this “Sumpoorn” created by Jocata carried an Index measuring economic activity of the MSMEs leveraging the GST data.

“The underlying authentic data of GST provides credibility to the Index and, with time, can be expanded to include more dimensions to provide a rich perspective on prevalent trends in the MSME sector,” he said.

Describing MSMEs as the “life-blood of the Indian economy,” Prashant Muddu, MD/CEO, Jocata, said “Sumpoorn is focused towards MSMEs manufacturing activity by monitoring economic activity through the “prism of sales.”

“+Sumpoorn+ is a ‘fact-based measure’ of MSME sales performance in the latest economic activity and would address the MSME knowledge gap alongside empowering financial institutions, policymakers, economists and researchers to strategize credit flow and creating tailored policies for sustainable growth of MSMEs across the country,” he said.

“To provide in-depth and granular MSME insights, we are further developing sub-indices that will identify growth opportunities, provide early warning signals and channelize capital allocation to different sectors and clusters across geographies,” he added.

Muddu said Jocata has successfully enabled over 50 large financial institutions in India, ASEAN and Middle East to embark on their digital transformation journeys. “Jocata’s MSME-inclusion approach began in 2021 following the launch of India’s first AI/ML-based score (SME DNA) that provided deep understanding of an entity’s performance across business cycles powering near-instant credit decisioning and faster disbursals,” he pointed out.