Dr. Anil Kumar Angrish

Ramisetty Sulochana

Pharmaceutical and Healthcare Multinational Corporations (MNCs) have their presence in India from many decades. GlaxoSmithKline Pharmaceuticals Limited was incorporated in 1924. Abbott India was incorporated in 1944, and Novartis India Limited was incorporated in 1947. Pfizer Limited was incorporated in 1950 when India became the Republic. Sanofi India Limited is present in India since 1956. At that time, it was in existence in the name of Hoechst Fedco Pharma Pvt. Limited. AstraZeneca Pharma was established in 1979. Procter & Gamble Hygiene & Health Care was set up in India as one of Merck’s Asian subsidiaries way back in 1967. These are prominent pharmaceutical and healthcare companies. Their parent companies are among top pharmaceutical and healthcare companies globally.

An interesting aspect of prominent Pharma and Healthcare Companies of foreign origin is that these companies operate in India through subsidiaries. Table 1 lists prominent parent MNCs and their subsidiaries in India. Out of these subsidiaries of Pharmaceutical and Healthcare MNCs, eight subsidiaries of seven MNCs given in the Table 1 are listed. Novartis India Limited, Abbott India Limited, Sanofi India Limited, Pfizer Limited, GSK Pharmaceuticals Limited, and AstraZeneca Pharma India Limited are listed entities on Indian stock exchanges. P&G has two subsidiaries listed on Indian stock exchanges – Procter & Gamble Hygiene & Health Care Limited and Procter & Gamble Health Limited. In Indian Pharmaceutical Market (IPM), subsidiaries of foreign Pharma MNCs command significant market share, and are among top-ranking companies. Abbott is number 2 in IPM as per IQVIA Market Reflection Report of January 2024. GSK was ranked 13th, Sanofi was ranked 18th, and Pfizer was ranked 20th as per Moving Annual Total (MAT) values.

Table 1:- Pharma and Healthcare MNCs in India and their subsidiaries

| MNCs | No. of Subsidiaries | Name of Subsidiaries in India |

| Novartis | 2 | * Novartis India Limited (NIL) * Novartis Healthcare Private Limited |

| Abbott | 2 | * Abbott India Limited * Abbott Healthcare Private Limited |

| Sanofi | 2 | * Sanofi India Limited * Sanofi Healthcare Private Limited |

| Pfizer | 3 | * Pfizer Limited * Pfizer Products Private Limited * Pfizer Health Care Private Limited |

| GSK ( GlaxoSmithKline ) | 2 | * GlaxoSmithKline Pharmaceuticals Limited * GSK Global Service Private Limited |

| AstraZeneca | 2 | * AstraZeneca Pharma India Limited * Alexion Business Services Private Limited |

| P&G ( Procter & Gamble ) | 3 | * Procter & Gamble Hygiene & Health Care Limited * Procter & Gamble Health Limited * Procter & Gamble Home Products Private Limited |

Source: Compiled from websites of respective companies

At present, valuations of listed subsidiaries of seven MNCs are much higher than their parent companies. Price-to-Earnings (P/E) multiples of India-listed MNCs reflect the premium that India-listed subsidiaries have as compared to their parent companies based on the EPS and Market Price as on April 22, 2024. For example, AstraZeneca Pharma India has a P/E multiple of 94.11 as compared to parent company’s P/E multiple of 34.5 which means P/E multiple of the MNC’s subsidiary is 2.73x of parent’s P/E multiple, and it is 4.68x in case of GSK Pharmaceuticals Limited as compared to the parent – GSK. Lowest one is 1.14x in case of Novartis India Limited in comparison to the parent – Novartis. It is 1.46x for Abbott India of the parent company’s P/E multiple. Valuation of P&G subsidiaries is also higher in comparison to their parent as reflected in the multiple of 2.60x and 1.32x.

Table 2: P/E Ratio of Parent MNC and India-listed subsidiaries of Pharmaceutical and Healthcare MNCs

| PARENT Company | P/E Multiple | Listed subsidiaries in India | P/E Multiple |

| Novartis | 23.16 | Novartis India Limited | 26.3 |

| Abbott | 33.42 | Abbott India Limited | 48.81 |

| Sanofi | 14.6 | Sanofi India Limited | 31.40 |

| Pfizer | 14 | Pfizer Limited | 38.89 |

| GSK | 13.34 | GlaxoSmithKline Pharmaceuticals Limited | 62.46 |

| AstraZeneca | 34.5 | AstraZeneca Pharma India Limited | 94.11 |

| P&G | 26.2 | Procter & Gamble Hygiene & Health Care Limited | 68.26 |

| Procter & Gamble Health Limited | 34.64 |

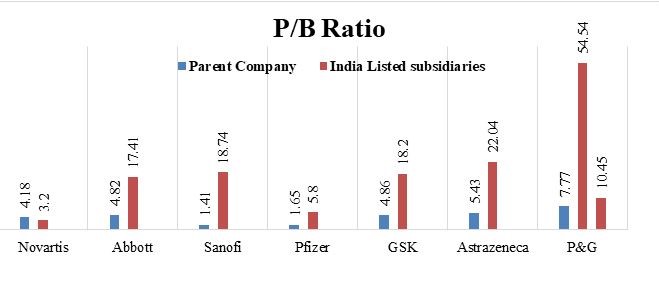

The Price-to-Book Value, or P/B ratio, is another valuation measure that relates a company’s market value to the value of its assets. It represents the price investors are willing to pay for each rupee of the company’s assets. The P/B multiple of Indian listed subsidiaries is also higher than that of their parent companies.

Figure 1: Comparative analysis of P/B Ratio of Parent MNC and its Indian subsidiaries

There are multiple reasons behind higher valuation of Indian subsidiaries of foreign Pharma MNCs. One major macro factor is overall increase in the benchmark indices and in overall market capitalisation of all listed companies. On May 23, 2024 India’s market capitalisation to Gross Domestic Product (GDP) surged to 1.42 times, or 142% as the market-cap of all BSE-listed companies stood at Rs. 420.22 Lakh Crore (or US$ 5.05 trillion), and with this, India became the fifth country after the USA, China, Japan and Hong Kong whose market capitalisation had crossed the US$ 5-trillion mark. Occasionally, BSE market capitalisation has dethroned Hong Kong too, e.g., India first surpassed Hong Kong on January 23, 2024.

Pharmaceutical sector-specific factors include advantage of being a subsidiary of an innovator company, wide range of coverage as subsidiaries of Pharma MNCs operating in India have portfolio that reflects India’s health challenges, among others. Abbott India Limited coves a wider range of therapeutic areas as compared to the parent company. Abbott India has a total of 14 therapeutic areas listed whereas the parent company focuses on 7 areas. This suggests a more diversified product portfolio tailored to the specific health needs of the Indian market. Shared focus areas put Indian subsidiaries at advantage as evident in case of Abbott. Both the parent company and the Indian subsidiary have a focus on Cardiovascular, Pain Management, Respiratory, and Women’s Health. These are key therapeutic areas for Abbott globally and in India, reflecting their importance in both markets. Similarly, Sanofi India Limited covers same therapeutic areas the parent company. This indicates a strong alignment in strategic focus and priorities between the global and Indian operations. The shared focus on Immunology & Inflammation, Neurology, Oncology, Rare Blood Disorders, Rare Diseases, and Vaccines suggest that these areas are critically for Sanofi globally as well as in India.

Even with higher P/E multiple and P/B multiple, India-listed subsidiaries of Pharma MNCs do not have significant valuation as compared to their parent pharmaceutical companies. For example, relative size of market capitalisation of AstraZeneca India Pharma Limited was just 0.72% of its parent company’s market capitalisation (translated in Rupee terms). It is understandable as parent pharmaceutical companies typically own multiple subsidiaries across various industries and markets. Besides this, parent companies often have more significant financial resources, larger-scale operations, and better access to capital markets. Parent Pharma company, India-listed subsidiary and unlisted subsidiary of same parent company differ in terms of primary business, and products/services. For example, Procter & Gamble Hygiene & Health Care Limited has primary business of Healthcare & Femcare and has products/services which include Vicks ointments, creams, cough drops, Whisper feminine hygiene products, Old Spice skincare items, Procter & Gamble Health Limited has primary business of Pharmaceuticals & Chemicals and products include multi-vitamin products, and chemical products for industrial use whereas in case of Procter & Gamble Home Products Private Limited, primary business is Personal Care, and products include conditioners, shampoos, styling aids, skin and personal care products.

Higher P/E multiple and P/B multiple of subsidiaries of Pharma MNCs in India is likely to encourage more foreign pharmaceutical and healthcare companies to get their subsidiaries listed on Indian stock exchanges as current valuations offer immense potential of monetising stakes. In this way, these companies get an opportunity to tap into a large investor base, and get attractive valuations. Many pharmaceutical and healthcare companies figure among top 100 companies but are unlisted such as Janssen, MSD, Boehringer, to name a few. Even domestic companies are realizing gains on account of higher valuation. In 3rd week of June 2024 itself, Pune-based Emcure Pharmaceuticals got the SEBI approval for the launch of its Initial Public Offering (IPO) that comprises a fresh issuance of equity shares worth Rs. 800 crore and an Offer for Sale (OFS) of 13.6 million equity shares.

MNCs from other sectors which have subsidiaries in India, are taking a cue from valuation premium in India. Most recently, Hyundai Motor India Limited (HMIL), Indian subsidiary of South Korean carmaker, Hyundai Motor Company (HMC) has applied to the SEBI for an IPO in which the parent is planning to offload 17.5 per cent of its stake to raise about Rs. 25,000 crore. This would make it the largest IPO in India (previous record is of LIC), and would value HMIL at about Rs. 2.5 trillion (or US$ 30 Bn). This is the 2nd attempt of Hyundai, the second largest carmaker in India by market share. In 1999, HMC had applied to the then Foreign Investment Promotion Board (FIPB) for selling 14.2 per cent equity, but South Korean banks as lenders had not approved the equity dilution. At that time, the valuation was around Rs. 2,000 crore. Dilution of stake through listing of Hyundai subsidiary in India will bring back funds from overseas operations. Here too, there is the role of P/E multiple and P/B multiple as P/E ratio of Hyundai in Korea is about 5.6 times. In contrast to this, the largest car maker in India, Maruti Suzuki’s P/E ratio for fiscal years ending March 2020 to 2024 averaged 40.0x.

Dr. Anil Kumar Angrish,Associate Professor (Finance and Accounting),

Department of Pharmaceutical Management,NIPER, SAS Nagar (Mohali), Punjab

Ramisetty Sulochana, MBA (Pham.), Department of Pharmaceutical Management,

NIPER, SAS Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.