Dr. Anil Kumar Angrish

Priya Tanwar

On July 15, 2024 Hindustan Unilever Limited (HUL) announced that the company has signed an agreement for the sale of its Pureit business to A.O.Smith for Rs. 601 crore ($72 million). HUL cited that the move is in line with the strategic intent to focus sharply on ‘core categories’. HUL had launched ‘Pureit’ in 2004 that had turnover in FY2023-24 of Rs. 293 crore, i.e., less than 1 per cent of HUL’s turnover. This decision to sell ‘water filter’ business by HUL demonstrated that FMCG company failed to undertake services as Pureit being a consumer durable product required after-sales service. In above background, the business was categorized as ‘non-core’. Other instances include launch of Kaya skincare clinics by Marico in 2002 and later on demerging that business. Godrej Consumer Products attempted to run salon business BBlunt but after few years, that business was sold to Honasa Consumer. It essentially called for understanding sector-specific nuances behind divestitures.

A divestiture is considered as “detaching part of a firm operations or assets through sell-offs, spin-offs, equity carve-outs, or split-offs”. The most typical form of divestiture is a ‘sell-off’ in which the buyer buys the entire asset in order to have complete control over it. Divestment has become an important corporate strategic tool through which companies get rid of their diversified non-core competency businesses. Due to price erosion attributed to generics, patent cliff, and intensified competition, even pharma MNCs are not finding it feasible to keep on getting bloated with multiple divisions.

Data obtained from annual reports of 24 pharmaceutical companies (17 top Indian pharmaceutical companies and 7 global MNCs) operating in India shows that there were at least 63 major deals which can be categorized under divestitures from 2016 to April 2024. These 24 pharmaceutical companies collectively hold 67.45 per cent market share. Out of these 24 pharmaceutical companies, there are 7 pharmaceutical companies namely Alkem, Aristo Pharma, Emcure IPCA Labs, Macleods Pharma, P&G Health, and USV which have not opted for any divestments during the period under consideration.

Out of 63 divestitures, global pharma MNCs operating in India executed 33 divestitures whereas Indian-origin firms executed 30 divestitures. Even out of 7 global pharma MNCs operating in India, just 6 firms have done active divestitures, still their number of divestments are almost equal to divestitures executed by top Indian pharmaceutical companies. This turns out to be almost 5 divestments per firm with respect to global pharma MNCs in India and about 3 divestments per firm with respect to pharmaceutical companies of Indian origin. With 9 divestitures, GSK Pharma is on the top followed by Glenmark Pharmaceuticals (8), Novartis India (8), Sanofi India (8), Pfizer (6), Sun Pharma (5), and Cipla (4). Nearly 76 per cent of total divestments were carried out by these 7 pharmaceutical companies, out of which 4 were global pharma MNCs and 3 were of Indian-origin pharmaceutical companies.

As stated earlier, sell-off is the most typical form of divestiture as supported by the data for the period under consideration for select 24 pharma companies. There were 47 sell-offs deals, 6 spin-off transactions, 8 stake divestment deals, and 2 swap deals. In other words, 74.60 per cent transactions involved sell-off. Out of 47 sell-off deals, global pharma MNCs dominated with 25 deals, and India-origin pharma companies had 22 sell-off deals. Business Swaps were executed by global Pharma MNCs only.

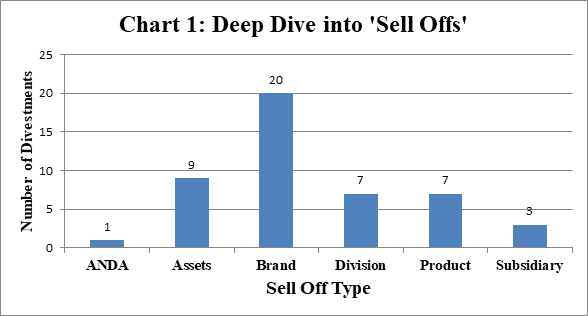

Within ‘Sell Offs’, ‘brand’ was the most divested type under the mode of ‘Sell off’. Out of 63 divestments, brand constituted about 31.74 per cent of divestments (20 in number) followed by ‘Physical Assets’, sale of a ‘Division’, sale of ‘Products’, sale of a ‘Subsidiary’, and Abbreviated New Drug Application (ANDA) as represented in Chart 1.

Examples include sale of two oral solid dosage manufacturing plants by Sun Pharma to Flontida BioPharma Inc., along with 15 related pharmaceutical products in 2016, transfer of erstwhile Ranbaxy’s ‘Solus’ and ‘Solus Care’ divisions to Strides in 2016. The company cited ‘manufacturing consolidation’ and ‘poor performance’ as the reason behind the sale of oral solid dosage manufacturing plants. Poor Focus was mentioned as the reason behind Division Sell Off as CNS business in India was not Sun Pharma’s strategic priority. Novartis India opted for Division Sell Off in 2016 when it sold its Animal Health business to Elanco India, an affiliate of Eli Lilly. It was in the background of the global call of ‘Strategic Focus’ and the company had an all-cash transaction to focus on its three leading businesses of global scale: Innovative Pharmaceuticals, Eye Care, and Generics.

Pfizer sold four brands to Piramal Enterprises in 2016. Brands included child nutrition supplement Ferradol, medicated soap Neko, pain reliever Sloan an cough syrup Waterbury. In 2016 itself, Zydus Healthcare Limited acquired six bands from pharma major MSD and its subsidiaries in India. MSD India aimed to focus on select core brands. In December 2015 also, the company had sold five OTC brands to Piramal Enterprises Limited. Sanofi India opted for ‘business swap’ when it opted for swap of Animal Health Division with Boehringer’s Consumer Healthcare Business. With this, Sanofi India established itself in Consumer Healthcare space.

This holds true for recent year transactions too. For example, in 2024, Sun Pharma has announced divestiture of a manufacturing facility located in Goa to a prospective buyer, and has been classified as ‘held for sale’. In 2023, Cipla divested its 51.18 per cent stake in Cipla Quality Chemical Industries Limited (QCIL), Uganda whereas Cipla continues to provide life-saving medicine in Africa via Cipla Global Access and also, continues to support QCIL by providing access to certain technology for a predetermined period. In another deal during 2023, Dr. Reddy’s Laboratories (DRL) divested certain ‘non-core brands (9 brands of dermatology portfolio) to Eris Lifesciences. In 2023 only, Glenmark Pharmaceuticals entered into a share purchase agreement with Nirma Limited to divest a 75 per cent stake in Glenmark Lifesciences.

Regulatory Issues and legal hurdles also play role in the decision regarding divestiture as evident from three instances. GSK closed its Bengaluru plant after finding carcinogenic contamination by the U.S. FDA. Novartis faced certain regulatory hurdles to sustain its business in its Japanese market while Cipla’s business was impacted by regulatory and geopolitical environment.

At the time of divestiture, management of companies mention the reason behind their decision. From the details captured about these companies, 49 out of 63 divestments had ‘strategic reasons’ behind divestiture and for 10 deals, the underlying reason was ‘financial reason’ whereas for 3 deals, ‘strategic as well as financial reasons’ were attributed. Strategic reasons mentioned included ‘Strategic Focus’ that meant decision to either focus on core business, or to enter new markets, gain market share in the operating geography, and new product launches, among others. Strategic Focus was emphasized as major reason cited in 65.30 per cent cases out of strategic reasons. Next most important reason among strategic reasons included mitigation of ‘poor performance’, thereby helping increase the efficiency in business. In addition to this, other strategic reasons were cited which included ‘to improve focus on the business’, ‘to tackle regulatory issues’, and a very small proportion was for ‘nurturing innovation’.

Financial reasons involved mainly having a ‘Short Term Financial Gain’. Divestments have been very commonly known to provide a quick fix for financial dearth. However, only in 15.87 per cent divestments, financial reasons were highlighted. Other reasons included getting ‘tax benefits’, and ‘to improve investor confidence’ in the firm. For example, Micro Labs sold off its plant located in Baddi, Himachal Pradesh due to change in government norms as tax exemption was no longer available for manufacturing units over there. Sanofi India stated that to reinstate faith of their investors that the company is focusing on branded products and not exclusively generics, the company opted for sale of their Ankleshwar generics manufacturing plant.

Number of divestitures executed show that there is a very healthy divestment culture among pharmaceutical companies (Pharma MNCs as well as Indian-origin top pharma companies) in India. Strategic Focus being the primary reason also reflects that divestments in Indian Pharmaceutical Industry has not only remained as a tool to earn a quick buck but rather it has deep connotations of strategic mindset behind it, i.e., either to enter new markets, to make the organization ‘Asset Light’, etc. Regarding Pharma MNCs operating in India, MNCs face limited product portfolios and penetration, primarily restricted to metropolitan and Tier-1 cities. Besides this, price cap on essential drugs is compelling MNCs to reassess their business strategies. For instance, Novartis handed over the rights of certain brands to DRL and terminated services of 400 employees. Eli Lilly sold its anti-diabetes drugs to Cipla and laid off 120 employees. These restructuring efforts by MNCs in India reflect a strategic need to optimize portfolios and address market-specific challenges. This trend is characterized by divestiture of mature brands, downsizing, and exploring innovative business models.

Divestitures by pharmaceutical companies in India reflect emphasis on a ‘leaner and focused’ model where pharmaceutical firms would only focus on businesses which are their core strengths. ‘Sell Offs’ within divestitures are preferred divestment tool and primarily opted for strategic reasons. To quote Vijay Govindarajan and Chris Trimble (from their paper titled, ‘The CEO’s Role in Business Model Reinvention’ that was published in Harvard Business Review – January-February 2011), for companies to endure, they must get the ‘forces of preservation’, ‘destruction’, and ‘creation’ in the right balance………..Forces of preservation reign supreme. Forces of destruction and creation are overshadowed, outmatched, and out of luck. To explain the three perspectives, authors used three main deities of Hinduism: Vishnu, the God of Preservation; Shiva, the God of Destruction; and Brahma, the God of Creation. Further, about pruning lines of business that are underperforming or no longer fit the company’s strategy, authors wrote – when Japanese firms commoditized the market for dynamic random-access memory – a key component in PCs – Intel co-founder Andy Grove shifted the company into microprocessors. Such divestitures are traumatic but not conceptually mysterious. Pruning simply requires commitment from powerful executives.

Dr. Anil Kumar Angrish, Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER, SAS Nagar (Mohali), Punjab

Priya Tanwar , MBA (Pharm.) Department of Pharmaceutical Management, NIPER, SAS Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.