New Delhi: Union Budget 2025-26 has reposed faith in the country’s Middle class and continued the trend of giving relief in tax burden to the common tax–payer.

During the budget presentation in the Parliament, Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman proposed an across-the-board change in tax slabs and rates to benefit all tax-payers.

Giving the good news to taxpayers, the Finance Minister stated, “There will be no income tax payable upto income of Rs. 12 lakh (i.e. average income of Rs.1 lakh per month other than special rate income such as capital gains) under the new regime.

This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000.” Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Sitharaman stated that, “The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment”.

In the new tax regime, the FM proposed to revise tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 per cent |

| 8-12 lakh rupees | 10 per cent |

| 12-16 lakh rupees | 15 per cent |

| 16-20 lakh rupees | 20 per cent |

| 20- 24 lakh rupees | 25 per cent |

| Above 24 lakh rupees | 30 per cent |

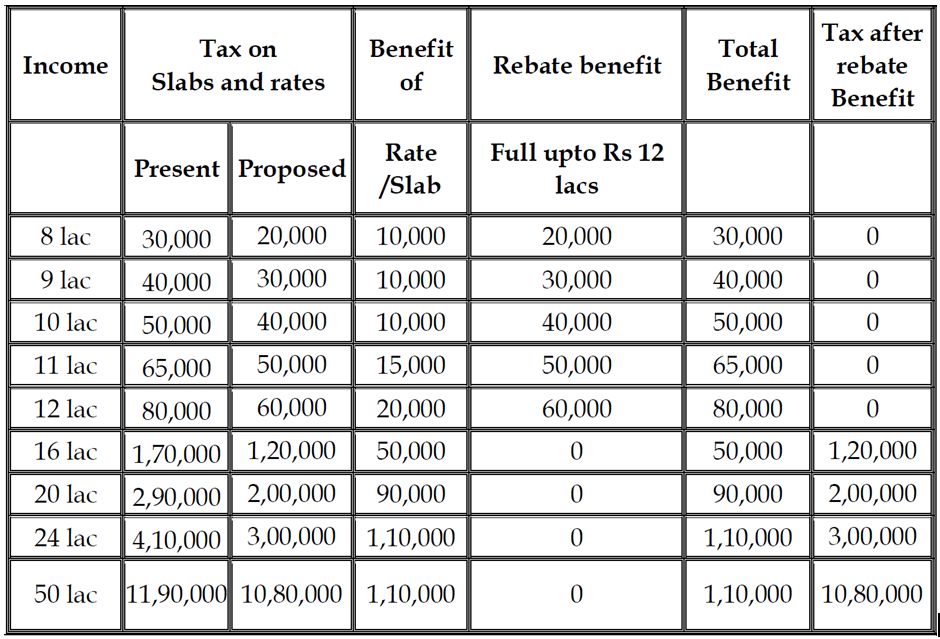

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

Underlining taxation reforms as a key to realize the vision of Viksit Bharat, the FM stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation.

Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Narendra Modi has taken steps to understand and address the needs voiced by our citizens, asserted Sitharaman.