Through Order dated March 27, 2025, the National Pharmaceutical Pricing Authority (NPPA) fixed the ceiling prices exclusive of Goods and Services Tax applicable, in respect of the Scheduled Formulations. Manufacturers of scheduled formulations have been allowed an increase of (+) 1.740228%. The ceiling prices have been made applicable with effect from April 1, 2025. The NPPA listed 748 medicines, along with their dosage form and strength, and Units (tablet, capsule, vial, dose in ML, GM, Metered dose, etc. as applicable). Where strength varies, the ceiling price is to be revised in same ratio, e.g., NPPA highlighted that the ceiling prices fixed for Paclitaxel Injection 30 mg/ 5 mL and 100mg/16.7 ml at S. No. 554 are also applicable to any other strengths (300mg/50ml, 260mg/41.7ml, 200mg/33.4ml etc.) of the Paclitaxel with same ratio, i.e., 6mg/ml.

Further, all manufacturers of scheduled formulations, selling branded or generic or both the versions of scheduled formulations at price higher than the ceiling price (plus GST) so fixed and notified have to revise the prices of all such formulations downward. All the existing manufacturers of these scheduled formulations having Maximum Retail Price (MRP) lower than the ceiling price notified may revise the existing MRP of their formulations, based on WPI announced for the year 2024 over 2023. Underlying reason behind the revision in the prices of scheduled formulations on yearly basis in India is to reimburse manufacturers for the increase in input costs due to inflation.

Revision in the prices of scheduled formulations is allowed as per the paragraph 16 (2) of the Drugs (Prices Control) Order, 2013. Scheduled formulation means any formulation which is included in the First Schedule of DPCO, 2013. National List of Essential Medicines (NLEM) that is published by the Union Ministry of Health and Family Welfare as updated and revised from time to time is included in the First Schedule of the DPCO, 2013.

Revision in the prices is based on the Wholesale Price Index (WPI) data which is provided by the Office of the Economic Advisor, Department of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry. Paragraph 16 of the DPCO provides for revision of the ceiling prices of scheduled formulations as per the annual WPI for preceding calendar year on or before April 1 of every year. In 2025, the Order came on March 27, 2025. There is always a time lag between the revision in the ceiling prices and the availability of these scheduled formulations with the revised prices in the market place. Existing stock levels also play an important part in the supply chain.

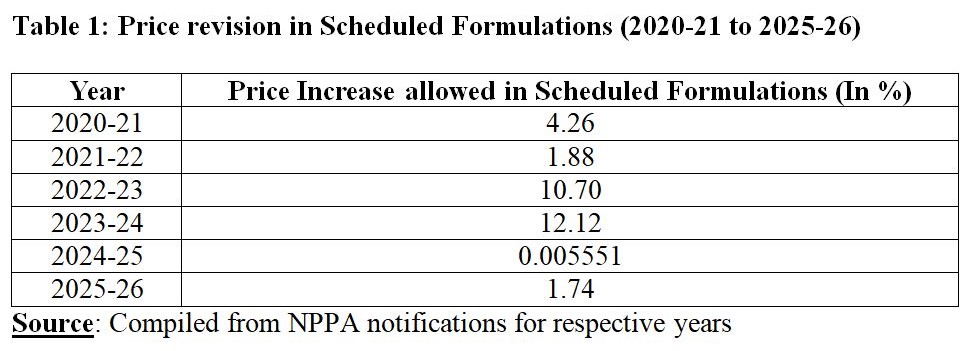

For 2023-24, prices of essential medicines had seen the highest annual increase. For two years in a row, i.e., for 2022-23, and 2023-24, the increase was more than 10 per cent. In 2024-25, the increase was negligible. Pharmaceutical companies asked for one-time exemption on negligible increase by citing administrative burden through printing new prices. Manufacturers of scheduled formulations also cite increase in the cost of inputs while asking for higher increase as in non-scheduled formulations, increase is allowed up to 10 per cent. Pharmaceutical industry also faces increase in cost of inputs like any other industry. If increase is inadequate then it has implications for the quality of pharmaceutical products in addition to availability of essential medicines. The Regulatory body has to ensure availability, accessibility, and affordability of medicines.

For 2025-26, the price revision will lead to increase of 1.74 per cent in the prices of scheduled formulations. But question is: Is 1.74 per cent increase representative increase given the fact that WPI does not give weightage to only pharmaceutical products. In July 2024, the Office of Economic Advisor in the DPIIT had suggested the shift towards a Producer Price Index (PPI) instead of the existing WPI. The idea was that the PPI will act as an indicator to measure the average change in the prices which producers receive for their products manufactured or services rendered. Prices captured are those that reflect prices at their factory gate or at the site of service providers. Essentially, elements such as taxes, trade margins, transportation cost, etc. gets excluded. But this will not be essentially capturing the essence of pharmaceutical sector.

January 2025 data on WPI shows that respective weightage of three major groups: Primary Articles with 22.62 per cent weightage, Fuel & Power with 13.15 per cent weightage, and Manufactured Products with 64.23 per cent weightage. Within Manufactured Products, manufacturing of Chemicals and Chemical Products and Manufacturing of Pharmaceuticals, Medicinal Chemical and Botanical Products are considered and these two sub-sectors have relevance for pharmaceutical sector. Out of 100, Manufacturing of Chemicals and Chemical Products have weightage of 6.47 per cent, and Manufacturing of Pharmaceuticals, Medicinal Chemical and Botanical Products have 1.99 per cent weightage.

This reflects the limitation of WPI in pharmaceutical sector. Sectoral indices can serve important purposes, e.g., the National Housing Bank (NHB) came up with the NHB RESIDEX in July 2007. It was India’s first Official Housing Price Index. The scope of the index has been widened under NHB RESIDEX brand. Now, it includes Housing Price Indices (HPI), Land Price Indices (LPI), and Building Materials Price Indices (BMPI), and also Housing Rental Index (HRI).

Sectoral Index for capturing inflation regarding pharmaceutical products is a complex issue. The very first transaction is between the manufacturer and the wholesaler. This has the variation in pharmaceutical sector as a manufacturer may have a captive plant of Active Pharmaceutical Ingredients (APIs) or APIs may be procured from outside including imports. Alternatively, in case of contract manufacturing, it is between manufacturer and marketer. This price is relevant for Producer Price Index. Next in the chain falls Wholesale Acquisition Cost (WAC). The WAC considers manufacturer’s list price for formulations to wholesalers. At this stage, there is role of rebates or incentives offered. Next transaction is between the wholesaler and the retailer. Final stage is when a patient/end consumer is purchasing the pharmaceutical product from the retailer.

DPCO, 2013 recognizes manufacturer (any person who manufactures or imports or markets drugs for distribution or sale in the country), wholesaler (a dealer or his agent or a stockiest engaged in the sale of drugs to a retailer, hospital, dispensary, medical, educational or research institution or any other agency), retailer (a dealer carrying on the retail business of sale of drugs to customers),

The Drugs (Prices Control) Order, 2013 refers to “maximum retail price” which means the ceiling price or the retail price plus local taxes and duties as applicable, at which the drug shall be sold to the ultimate consumer and where such price is mentioned on the pack. The DPCO, 2013 provides for calculation of ceiling price of a scheduled formulation by considering “Average Price to Retailer” and provides a margin to retailer. Percentage margin to retailer is 16 per cent. “Price to Retailer” is referred as the price of a drug at which it is sold to a retailer which includes duties and does not include local taxes.

Sectoral price index will be helpful in fixation of ceiling price of a drug under certain circumstances (Para 19 of the DPCO, 2013) when it is considered necessary to do in public interest, and an increase or decrease is to be allowed in the ceiling price or the retail price. Such an increase of decrease is allowed irrespective of annual wholesale price index for that year. This essentially reflects shortcoming of capturing inflation in existing framework. Prices of non-scheduled formulations are also monitored. Para 20 of the DPCO, 2013 deals with ensuring that no manufacturer increases the MRP of a drug more than ten per cent of MRP during preceding twelve months. Appropriate sectoral price index that captures sectoral inflation can provide a sound basis for allowing the increase. Fixation of retail price of a new drug which is not available in domestic market requires application of principles of “Pharmacoeconomics” through involvement of the Standing Committee of Experts.

To conclude, sectoral index in pharmaceutical sector can be a better measure to factor inflation for pharmaceutical products rather than Wholesale Price Index which is being applied presently. Through sectoral index, inflation pertaining to pharmaceutical sector-specific variables can be captured appropriately rather than including the weightage of those items which are not directly relevant to pharmaceutical sector but included in WPI. The scope can be widened over a period to make Pharma Sector-specific Index more comprehensive.

Dr. Anil Kumar Angrish– Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.