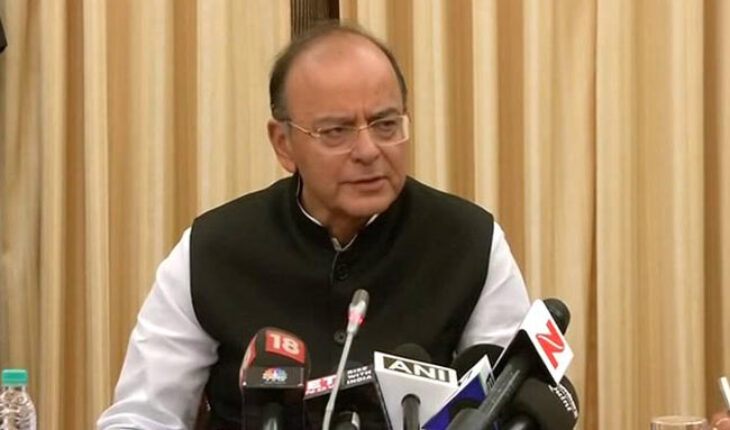

Deposits of “overwhelmingly large amount” of money in banks has ended anonymity around it and helped fix liabilities, Finance Minister Arun Jaitley said a day after the apex bank revealed that almost all of the Rs 15.44 lakh crore junked currency had come back.

The fallout of the demonetisation of old 500 and 1000 rupee notes was on predicted line, with a hit on economic activity in one to three quarters but gains would accrue in medium to long term from integration of formal and informal economy, media reports quoted him as saying.

The RBI, which had so far shied away from revealing how much of junked currency came back to system post the November 8 note ban decision, in its annual report yesterday said banks have received Rs 15.28 lakh crore, or 99 per cent of the currency invalidated, the report said.

According to submissions by its lawyers in the Supreme Court, the government had initially estimated about Rs 5 lakh crore would not come back into the banking system as holders of unaccounted money may find it difficult to deposit them in banks – the only source allowed for getting rid of old currency.

Jaitley reportedly said despite the pain associated with demonetisation, the country was ready for this kind of change.

“It’s nobody’s case that the black money has totally been eliminated. There are still people who will be doing such transactions. But, I think, a large amount of that has come in,” he said.

Speaking at the Economist India Summit here, Jaitley termed as a “very narrow vision” to consider just the dent in RBI’s profit due to printing of new currency as the cost of demonetisation.

“When the demonetisation was initially announced there was an element of uncertainty. There has not been many such experiments world over and therefore it is natural that there will be speculation as to how much money will come back,” he was quoted as saying by PTI.

The banned notes formed 86 per cent of the currency in circulation at that time. Holders of old notes were given a 50-day window to deposit them in banks, media reports pointed out.