New Delhi : Describing the decision of the RBI to keep the benchmark policy rates unchanged as pragmatic for sustainable economic growth, ASSOCHAM on February 8 applauded RBI’s direction to banks and other lenders to provide all-inclusive interest cost details to retail and MSME borrowers for greater transparency.

“While the continued focus on moderating inflation to the target of four per cent has to be seen in the overall context of global and domestic challenges, mainly with regard to food prices, RBI’s customer -centric approach is laudable. Complete impact of various charges levied by banks on the total cost of borrowing through disclosures would help borrowers, particularly the MSMEs,” ASSOCHAM Secretary General Deepak Sood said.

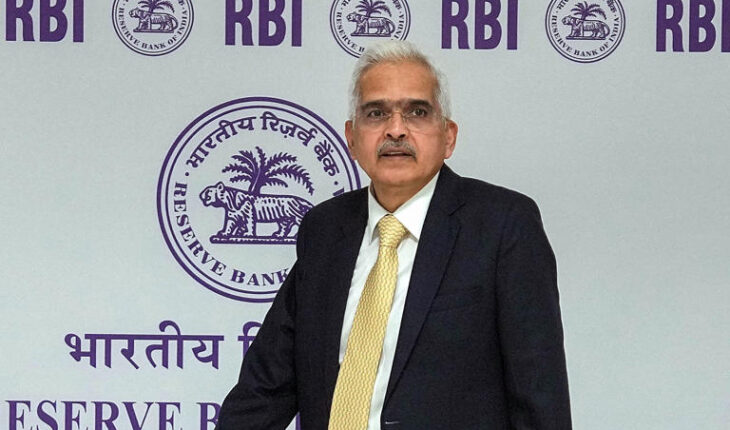

He said while the banks have of late been facing the challenge of credit-deposit growth mismatch, ”Governor Shaktikanta Das’ assurance that the RBI would remain nimble and swift in its response to ensure liquidity conditions , should give us comfort about credit demand being met sufficiently by the banks”.

The assessment of the RBI-Monetary Policy Committee about the economic outlook projecting growth rate at 7 per cent for the fiscal 2024-25 is a re-assertion of India’s robustness and resilience in macro parameters, be it foreign exchange reserves, consumer demand, investment sentiment and performance of the services and manufacturing sectors.

Sood also welcomed regulatory measures like enlarging the scope of hedging of gold prices in the International Financial Services Centre (IFSC) and making digital infrastructure more robust and safer.

Further progress on the Central Bank Digital Currency pilot would keep the Indian digital ecosystem globally compliant and futuristic. All in all, the RBI credit policy, after comprehensive deliberations by the Monetary Policy Committee, is well balanced and pragmatic, the chamber said.