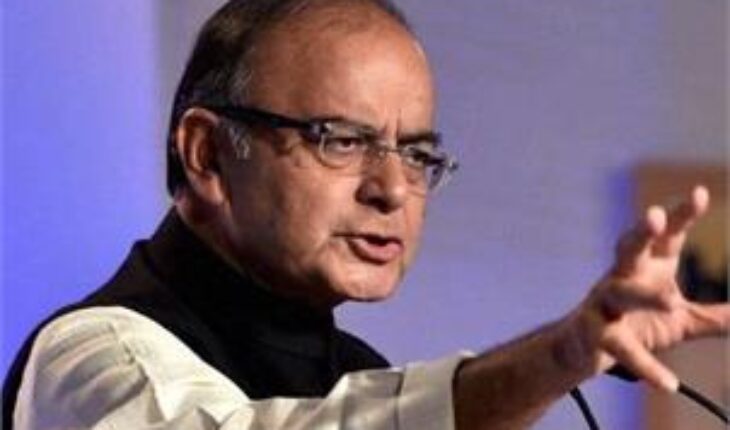

Bengaluru: , Asking people to come clean on unaccounted wealth and live with “heads held high”, Finance Minister Arun Jaitley has said government is aware of sectors generating black money but it would be unpleasant to start the “big brother watching” process.

Government, he said, has to trust its citizen and hence keeping a watch on their transactions is not a very happy thing for it to do.

Pressing black money holders to come clean under the Income Declaration Scheme (IDS), Jaitley said the policy of the government is to gradually nudge and push India to become a tax paying society rather than a tax evading one. “It is an opportunity for tax payers to come out clean, clean up their books, sleep well and live with their heads held high. Those who pay taxes lead a life without fear,” Jaitley said. He added: “I’m sure it’s an opportunity which is being granted, you will understand the idea behind this scheme is to slowly nudge India in to becoming more and more compliance state. As you become a compliance state, I think it is good for the country…” Noting that tax rates are reasonable in the country and in future non-payment in all likelihood is going to be detected, he said it is extremely important to pay taxes, also at a time when India is emerging as strong economy. He further said: “Tax department is aware of the sectors in which unaccounted money is generated. It is very unpleasant duty for any state for it to start the process of big brother watching. “Any government has to trust its citizens and therefore to keep watching their transaction is not a very happy thing for a government to do.” Jaitley was addressing an IDS event, organised by the Department of Income Tax in association with Institute of Chartered Accountants of India, and industry bodies Ficci and Federation of Karnataka Chambers of Commerce and Industry. It was attended by Revenue Secretary Hasmukh Adhia among others. The Finance Minister said tax rates are moderate in India as far as the direct taxation is concerned, compared to other economies in the world, leaving out tax havens and tax exempted societies. “If you look at the developed world or even emerging economies and compare them with India and do this comparative study of international taxation, our tax rates are extremely moderate compared to the rest of the world,” he said. — PTI