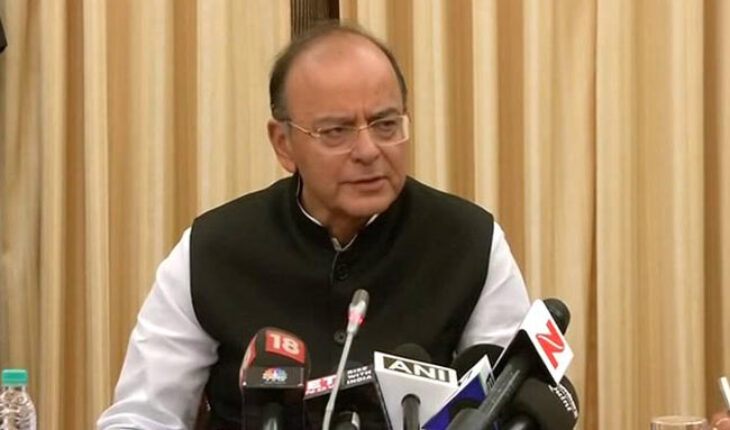

Finance Minister Arun Jaitley is set to begin speech at 11 am, will respond to questions on Twitter at 7 pm.

NDA’s last full-year Budget: This is the last full-year Budget before the 2019 general elections and assembly polls that are due in eight states this year.

Farmers and poor in focus: The budget is expected to focus on farmers, the rural poor and small businesses.

To keep investors’ confidence, Prime Minister Narendra Modi’s government will need to be seen containing the fiscal deficit, while also increasing spending in key areas of a slowing economy.

Opposition sets strategy: UPA chairperson Sonia Gandhi is likely to chair a meeting of opposition leaders tomorrow to plan a joint strategy for the ongoing Budget Session of Parliament. According to sources, the meeting is slated to be held in the Parliament Library Building in the evening after the presentation of the Union Budget tomorrow morning by Finance Minister Arun Jaitley.

Tamil Nadu eyes ‘necessary’ funds: Tamil Nadu Deputy Chief Minister O Paneerselvam on Wednesday expressed confidence that the Union budget will allocate the required funds for Tamil Nadu.

Higher non-tax revenue eyed: Edelweiss Group chairman Rashesh Shah, who also heads the industry lobby Ficci as its president, has called for laying down a strategic road-map in the Budget to ensure higher non-tax revenue.

Markets cautious: The benchmark indices on Wednesday fell for the second consecutive day on Wednesday as traders cited weak global cues and position unwinding ahead of the Budget as the primary reasons behind the weakness. Apprehensions about a re-introduction of long-term capital gains tax weighed on sentiment.

Transparency sought: Claiming that the budgetary process in India was not transparent enough, an NGO on Wednesday urged the government to place more information related to the budget in the public domain. The Transparency International India has said on parameters of international standards on budget transparency, the Indian budget was considered “less transparent” as it put only “limited” information in the public domain. “Budgetary process in India is still non-transparent, non-participative with poor accessibility by citizenry,” it said in a press release in New Delhi.

West Bengal presents farmer-friendly budget: West Bengals budget for 2018-19, presented in the assembly on Wednesday, announced a number of relief measures targeting the agriculture sector.

Finance Minister Amit Mitra, in his budget speech, announced relief in payment of stamp duty fees for the rural sector, exemption of agriculture tax and cess on green tea leaves, mutation fees exemption for farmers, farmers pension, and creation of corpus for assisting them.

The panchayat polls in the state are due in the next three-four months, agencies reported.

The budget also announced various measures for women like increase of Kanyashri scholarship and introduction of marriage assistance under the Rupashree scheme with an initial outlay of Rs 1,500 crore.

The government also announced measures to help the physically challenged by increasing their pension amount from Rs 750 to Rs 1,000 per month that will benefit 2 lakh people.

The outlay for this scheme, named Manabik, has been pegged at Rs 250 crore.

Stamp duty payment in the rural areas for properties between Rs 40 lakh and Rs 1 crore had been reduced from 6 to 5 per cent.

For the urban sector too, the stamp duty has been reduced from 7 to 6 per cent.

The government also proposed to create an assistance corpus of Rs 100 crore for the farmers to be given out when in distress, and increase in farmers pension from Rs 750 to Rs 1,000 per month to cover 1 lakh beneficiaries.

The size of the budget for the year 2018-19 is Rs 2,14,958 crore, Mitra said, adding the state has been able to create employment for 8.92 lakh persons despite the adverse impact of the Goods and Services Tax (GST) and demonetisation.

The budget also proposed an additional resource mobilisation under tax revenue of Rs 1,870 crore during the year, agencies reported.

Expectations as per the past reports:

- The government may tweak income tax slabs and rates in today’s budget to bring down burden on individuals, according to a survey by tax and advisory firm Ernst & Young.

- Arun Jaitley has already made it clear that the agriculture sector will be the top priority for the government in this year’s budget as the government attempts to address farmer distress ahead of the key state and national elections.

- The budget will be watched closely for the fiscal deficit target for the next year. The Economic Survey, which was tabled on Monday, called for a pause in fiscal consolidation, leading to concerns that the government could widen its fiscal deficit targets for 2018-19.

- Markets will be focused on how much the government widens its fiscal deficit beyond the 3 per cent of gross domestic product (GDP) projected for 2018-19. A Reuters poll showed most economists expect a 3.2 per cent deficit as the government looks to increase investments in areas like agriculture.

- A modest widening of that nature would calm investors worried that the government may slip away from its judicious spending. But a deficit above 3.2 percent could hit shares and send bond yields up by 20-25 basis points, depending on the size of the blowout, on fears of populist policy ahead of next year’s elections.

- A prudent budget could also soothe the Reserve Bank of India, which holds a policy review on February 6 and 7 amid worries it could raise rates in coming months after inflation hit a 17-month high in December, well above its 4 percent target.

- While investors expect some spending to support an economy that’s expected to post its weakest growth in four years, they will want to see such stimulus is well-financed. Growth was impacted by the launch of the goods and service tax last year and a shock move to ban high value currency notes in late 2016, which hit tax revenues and increased the chances of a fiscal deficit shortfall.

- An expected pickup in growth next fiscal year and state asset sales estimated to raise 1 trillion rupees ($15.74 billion) should boost tax revenues.

- The government is also expected to stay on course with its focus on building highways and modernising the railways. Mr Jaitley had allocated a record Rs. 3.96 lakh crore to infrastructure sector in last year’s Budget.

- Experts don’t see the possibility of a big cut in corporate tax rate for India Inc given the fiscal constraints. In his Budget speech of 2015-16, Mr Jaitley had said proposed reduction of the rate of corporate tax from 30 per cent to 25 per cent over the next four years.