Public spending is essential for economic growth and balancing development. It helps in building a conducive infrastructure for the growth of the private sector and thus, crowds a large pool of private investment into the economy. Since independence, India has set a good example ofa mixed economy where, both the public and private sectors co-exist with dignity and harmony and celebrate each other’s glory.

Spending by both the public and private sectors in creating fixed assets, such as machinery and equipment, and the development of new technology is called Gross Capital Formation (GCF). The GCF helps in value addition to growth and generating new employment opportunities in the economy.

In 1950, the total GCF share in India’s GDP was 15 percent which included 3 percent from the public sector and the rest 12 percent from the private sector. The pre-reform period witnessed rising participation from the public sector in capital formation. In 1990, the total GCF share in India’s GDP was 27 percent with 10.5 percent from the public sector and 16.5 percent from the private sector.

The macro-economic reforms in 1991 helped the opening ofthe economy and liberalisation of various restrictive trade practices which resulted in the growth of private sector participation.Between 1991 and 2007, the private sector GCF share in India’s GDP went up to 32 percent whereas, the public sector share remained in the range of 7 to 9 percent.

The economic downturn in 2008 and its post-era witnessed a sharp decline in private-sectorinvestment with no change in the status quo of the public sector. In 2019-20, the total GCF share in India’s GDP was 30 percent with 23 percent share from the private sector and 7 percent from the public sector.

Further, the 2020 covid-19 pandemic and subsequently, the other global headwinds such as the Ukrainian war expected to bring down the sentiment of private sector investment in the economy. Therefore, the need of the hour is to raise the public sector investment in capital formation to encourage private-sector participation and to bring the economy back to equilibrium with higher growth and stability.

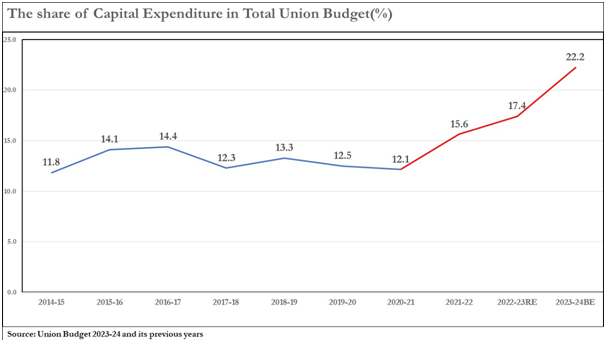

Since 2021-22, the union government has adopted a policy to increase the capital outlay share in its total spending.In 2020-21, the capital outlay in the total union budget was 12.1 percent which was 0.3 percent higher than the same in 2014-15. In 2021-22, this share increased to 15.6 percent, and further in 2022-23(RE), it increased to 17.4 percent.

The union budget 2023-24proposed a capital outlay of Rs.10 lakh crores which is a rise of about 33 percent from the previous year’s BE and, compared to the previous year’s RE, the rise is about 37.4 percent. The capital outlay in this budget FY24 has received a higher priority with a 22.2 share in the total budgeted expenditure.

In the whole government’s policy framework of capital spending in 2023-24, the physical infrastructure adorns the highest priority. Both, the Ministry of Road, Transport and Highways (MoRTH) and the Ministry of Railways (MoR) share about 50 percent of the total budgeted capital outlays. The capital outlay of about Rs. 2.6 lakh crores is provisioned for the MoRTH and the MoR is provided with a capital outlay of Rs. 2.4 lakh crores in 2023-24. The Ministry of Defence stands as the other major stakeholder in the total budgeted capital outlay of about Rs. 1.7 lakh crores.

Capital formation in the physical infrastructure certainly improves connectivity and thus, supports easingthe transport of raw materials at lower cost, and again, facilitates the reach of the final output to each single demand hub. The life cycle of the product improves with the development of physical infrastructure and contributes to the growth of the industry.

During the post-pandemic period, the industrial sector witnessed a slower rate of recovery. The Index of Industrial Production (IIP) registered a growth rate of 5.4 percent during April-December in 2022 compared to its previous year. The growth rate recorded in the last week of December 2022 is less than 5 percent.

Further, there is a reduction in the share of industrial products including construction in India’s GDP during the post-reform period. In 1991, the share was about 35 and it came down to 28 percent in 2021-22. Manufacturing shares 16.7 percent followed by 7.3 percent share from the construction sector, 2.2 percent from electricity, and 2.1 percent from the mining sector in India’s GDP in 2021-22.

The economic growth and development of a nation depend on the strength of its industrialisation. The industrial sector generates value addition and provides employment opportunities. It absorbs the surplus labour force in the economy which remained disguised in the agriculture and allied sector. The forward movement of the public sector through higher capital investment is certainly a welcome step to help the private industries mostly the micro, small and medium ones (MSMEs) to grow and develop.

However, the past trend shows that the total budgeted capital outlays are not fully utilised within the limited time frame. In the current year 2022-23, the RE of capital outlay is 2.3 percent lower than the BE. In 2014-15, the difference between the BE and Actual capital outlays was 15 percent and in 2017-18, this difference was 18 percent. The difference shows the delay of a project which would add to rising cost overruns and thus,limit the growth process. The government’s administrative machinery needs to build strength and maintain transparency in completing the projects on time which would restore confidence in the private sector and encourage them to join with the public sector in nation-building.

Dr. Sridhar Kundu, Bharti Institute of Public Policy ,Indian School of Business, Mohali, Punjab