Buoyed by the increasing demand for housing in the wake of Prime Minister Narendra Modi’s vision to provide ‘Housing for All’, Capri Global Housing Finance Limited (CGHFL) — a subsidiary of Capri Global Capital Limited (CGCL) — is targeting ‘29X’ growth in AUM to cross Rs 7,000 crores in the next four years. CGCL is a leading NBFC lending primarily to MSMEs and Affordable Housing sector.

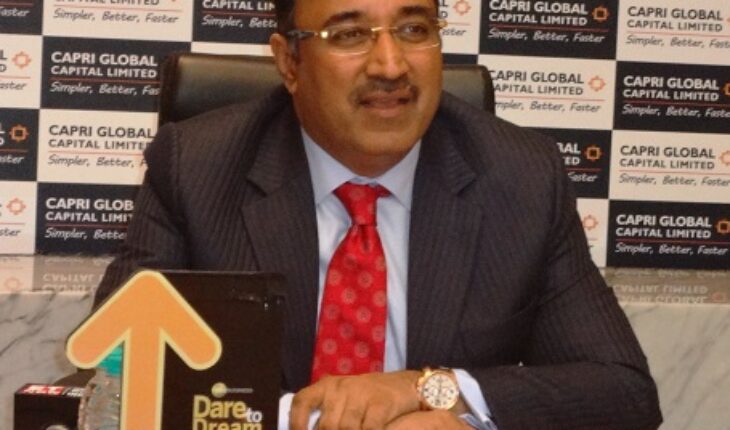

Noting that the company is aligned with the Prime Minister’s mission of ‘Housing for All’ under the Pradhan Mantri Awas Yojana that is driven by UNDAP, Rajesh Sharma, Managing Director, CGCL, said here today that CGHFL is engaged in servicing the underserved and deserving Lower and Middle Income families’ borrowers with a customized lending process driven by extensive quality checks and robust underwriting, where it has an average ticket size of Rs 11 lakhs.

“India is urbanizing at the rate of 1.2% per year and we remain optimistic about growth in our housing finance segment. Currently, the company has a strong presence in the Northern and Western regions, alongside plans to expand business in new geographies like Tamil Nadu, Karnataka and Andhra Pradesh, besides also setting up a network comprising 232 branches by FY23,” he said, adding that the company has invested in a client-centric, process-driven technology for better customer experience.

“Rapid industrialisation and migration to cities have caused massive urban housing shortages in India, specifically for the economically-weaker sections, and the NDA Government plans to build two crore affordable houses by March 2022. Mortgage penetration too in India remains a decade behind other emerging markets like China and Thailand. However, due to various structural economic drivers such as a young working population and rising economic levels, growth rates in the mortgage segment will remain healthy over the longterm,” he said.

Highlighting CGCL’s total AUM at Rs 3,489 crores as on September 30, 2018 and Net Worth at Rs 1,302 crores with operations across 76 branches in 8 states, Sharma said the company’s loan-taking customers comprised self-employed (55%) and salaried (45%), besides its loan-providing efforts reaching out also as far as gram panchayats and ‘gaothans’ on the outskirts of cities.

The importance of women being included in the loan-takers applications too was highlighted when Sharma noted that “besides empowering the about half billion own-home seeking, low-earning peopl e, the company is promoting women as house-owners (who comprise 20% of home finance loan borrowers.) Unless women are co-applicants or second applicant for these housing loans, Government credit subsidy – which we credit to the customers account and have given to 900 customers so far — will not be given.”

“The urban housing shortage is expected to reach 34.1 million units by 2022 and we are committed to working with the Government for building 30 million houses by 2022 for the rural poor and mitigating the environmental footprint of housing. Housing finance demand is pegged at US$ 1.2 trillion over FY18 to FY24. Low Income Group and Economically Weaker Sections face over 96% of urban housing shortage,” he said, adding that the company has signed an MOU with NHB to facilitate subsidy for them.

“Retail housing loans are growing at 18% and ICRA estimates affordable housing growth over medium to long-term like to be 30% higher than overall housing credit growth of 16% to 18%. Today, the affordable housing AUM has a huge market potential that is estimated to reach 6 lakh crore by 2022 and there is a huge rising demand being witnessed in Tier II and Tier III cities. Higher transparency in this sector will boost the housing finance market.”

Sharma said that, on a positive note, growth in the affordable housing sector would bring along with it a spurt in growth of peripheral industries that would create jobs and finances.

Dwelling on the MSME sector, Sharma said that according to an International Finance Corporation report in 2017, small businesses in emerging markets such as India are battling a finance gap of US$ 2 trillion. “Our survey showed that extending credit has helped business growth among first-generation entrepreneurs including women entrepreneurs. Of the surveyed, 62% are first-time loan applicants, creating the first footprint in the formal financial system,” he said

Describing the home owners category of people as a large floating population that regularly migrates to larger urban centres in search of jobs, creating pressure and leading to probable social imbalances, he said finance for affordable home ownership created a positive and energized local neighbourhood.