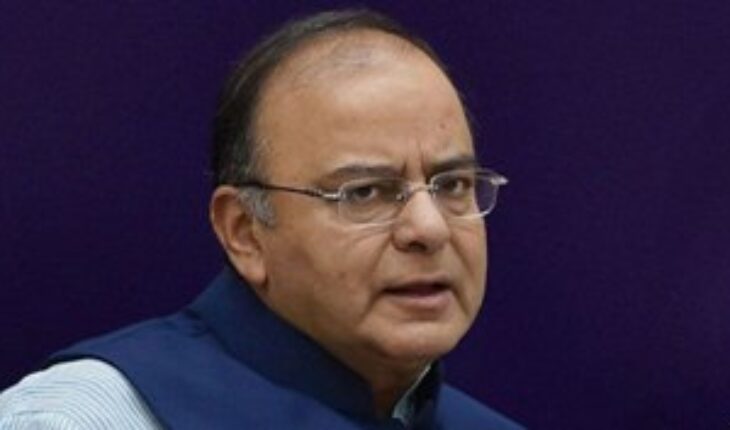

NEW DELHI: in order to attract more foreign investment, Finance Minister Arun Jaitley on Monday proposed significant liberalisation of FDI norms in a host of sectors including insurance, pension, ARCs and stock exchanges.

In the insurance and pension sectors, foreign investment will be allowed through automatic route for up to 49 per cent subject to the guidelines on Indian management and control, to be verified by the regulators.

Earlier, foreign investment up to 26 per cent was allowed through automatic route. Similarly, 100 per cent FDI in Asset Reconstruction Companies (ARCs) will be permitted through automatic route. Earlier it was allowed only up to 49 per cent. Jaitley also said that foreign portfolio investors (FPIs) will be allowed up to 100 per cent of each tranche in securities receipts issued by ARCs subject to sectoral caps. Besides, investment limit for foreign entities in Indian stock exchanges will be enhanced from 5 per cent to 15 per cent on par with domestic institutions. “This will enhance global competitiveness of Indian stock exchanges and accelerate adoption of best-in-class technology and global market practices,” he said. Further, the existing 24 per cent limit for investment by FPIs in central public sector enterprises, other than banks, listed in stock exchanges, will be increased to 49 per cent to obviate the need for prior approval of government for increasing the foreign portfolio investment. Jaitley said FDI will also be allowed beyond the 18 specified NBFC activities in the automatic route in other activities which are regulated by financial sector regulators. With a view to promote ‘Make in India’ and following the practices in advanced countries, foreign investors will be accorded “residency status” subject to certain conditions. Currently, these investors are granted business visa only up to five years at a time. In order to ensure effective implementation of Bilateral Investment Treaties (BITs) signed by India with other countries, the minister proposed to introduce a “Centre State Investment Agreement”. “This will ensure fulfilment of the obligations of the state governments under these treaties. States which opt to sign these agreements will be seen as more attractive destinations by foreign investors,” he added. . The basket of eligible FDI instruments will be expanded to include hybrid instruments subject to certain conditions, Jaitley said. All these decisions, he said, “will facilitate ease of doing business for foreign investors and their domestic recipients”. The government has already relaxed the FDI policy in over a dozen sectors, including defence, railway, medical devices and civil aviation. FDI into the country increased by 40 per cent to $29.44 billion during the April-December period of the current fiscal. — PTI