Dr. Anil Kumar Angrish

Isha Anand Tated

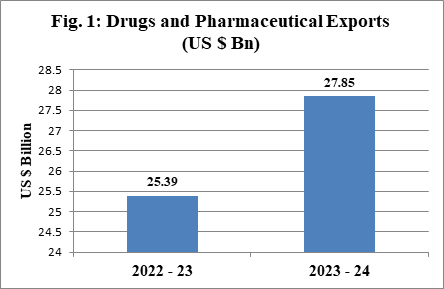

Foreign exchange exposure is the sensitivity of changes in the real domestic currency value of assets, liabilities, or operating incomes to unanticipated changes in exchange rates (Adler & Dumas, 1984). Pharmaceutical companies in India are continually exposed to the danger of fluctuating exchange rates because of their growing global presence. Pharmaceutical companies in India face forex exposure due to their global exports and imports. Drugs & Pharmaceutical exports from India remained a key driver of merchandise export growth from India in FY 2023-24. In FY 2023-24, drugs and pharmaceuticals export touched a new level of US $ 27.85 Bn as compared to exports of US $ 25.39 Bn in FY2022-23, thereby registering a percentage increase of 9.67 per cent. Drugs and pharmaceutical exports formed 3.59 per cent of overall exports (merchandise as well as services) from India. Merchandise exports for 2023-24 stood at US $437.06 Bn and Services exports for the same period stood at $339.62 Bn. So, exports of Drugs and Pharmaceuticals form 6.37 per cent of merchandise exports. Drugs & Pharmaceuticals remained one of 17 sectors which exhibited positive growth of 12.73 per cent in March 2024 as compared to same period during last year, i.e., March 2023. Overall, 17 out of 30 key sectors have shown positive growth in March 2024 as compared to the same period of previous year. On import front, Medicinal & Pharmaceutical Products have exhibited negative growth (- 2.85%) in March 2024.

It is not only overall exports and imports but the country-specific forex rate fluctuations, e.g., Indian Rupee vs. US$. Quantum of overall pharmaceutical exports to that economy and imports from that economy also determines impact of exchange rate fluctuations, e.g., the USA remained the top most market for pharmaceuticals from India as it accounted for 31.34 per cent of India’s Drugs and Pharmaceutical exports for 2023-24. Growth rate of exports to the USA was 15.66 per cent during FY23-24 as compared to FY22-23. The USA, United Kingdom (UK), South Africa, Netherland, and France constituted 41.65 per cent of overall exports from India’s Drugs and Pharmaceuticals. Besides the USA, growth rates for FY2023-24 remained in double digits for UK (21.12 per cent), Netherland (17.64 per cent), and France (17.14 per cent).

Pharmaceutical company specific impact can be observed from the sensitivity of changes in their real domestic currency value of assets, liabilities, or operating incomes. Revenue split in terms of domestic revenue and revenue from foreign countries becomes pertinent in this regard. Foreign exchange earnings and outgo give overall picture (Table 1).

Table 1: Forex earnings and outgo of top 20 pharmaceutical companies in India for 2023

Rs. in Million

| Company | Forex Earnings | Forex Outgo |

| Sun Pharma | 154,052.60 | 71,511.40 |

| Cipla | 64,281.70 | 20,201.80 |

| Dr. Reddy’s Labs | 1,28,803.00 | 41,484.00 |

| Divi’s Labs | 66,536.80 | 15,714.70 |

| Zydus Lifesciences | 67,577.00 | 20,544.00 |

| Mankind Pharma | 1,795.19 | 870.67 |

| Torrent Pharma | 20,994.20 | 3,735.30 |

| Lupin | 48,057.30 | 21,751.70 |

| Aurobindo Pharma | 85,483.30 | 41,447.20 |

| Alkem Labs | 16,916.30 | 4,189.50 |

| Abbott India | 309.80 | 5,817.50 |

| Ipca Labs | 26,434.20 | 8,177.50 |

| GSK | 1,621.67 | 15,629.95 |

| Glenmark | 46,463.66 | 12,712.17 |

| Gland Pharma | 30,589.57 | 17,818.72 |

| JB Chemicals | 8,943.28 | 2,142.58 |

| Ajanta Pharma | 22,420.20 | 4,293.10 |

| Laurus Labs | 43,470.00 | 13,720.00 |

| Sanofi India | 3,904.02 | 4,036.77 |

| Alembic Pharma | 15.68 | 29.90 |

Source: Compiled from Annual Reports of respective companies (2023)

It can be observed from above table that for certain pharmaceutical companies forex earnings and outgo is comparatively low, e.g., Abbott India, or Alembic Pharma whereas it is very high for certain companies like Sun Pharma, Dr. Reddy’s Laboratories, Aurobindo Pharma. Certain pharmaceutical companies are export-intensive in nature as they get huge chunk of their revenue from overseas. There are pharmaceutical companies which are import-intensive in nature which rely heavily on imports, and resultant forex outgo is on higher side for those companies.

Effect of exchange differences on restatement of foreign currency cash and cash equivalents can be significant, e.g., translation exposure of Glenmark was found to be the highest amongst top 20 companies. It was Rs.918.11 million in 2023. It was Rs. 731 mn for Zydus Lifesciences, Rs. 445 mn for Dr. Reddy’s Laboratories, and Rs. 195.30 mn for Sun Pharma for FY23.

External Commercial Borrowings (ECBs) have implications for pharmaceutical companies in India as funds are borrowed in foreign currency-denominated debt via the ECB and trade credit. ECBs can include Commercial Bank loans, Buyers’ Credit, Suppliers’ Credit, Securitized Instruments like floating rate notes and fixed rate notes, Credit from official export credit agencies, or commercial borrowings from multilateral financial institutions, e.g., International Finance Corporation. ECBs must meet certain parameters such as minimum maturity, permitted and non-permitted end uses and maximum all-in-cost ceiling. Certain companies have faced crisis in past on account of Foreign Currency Convertible Bonds (FCCBs), e.g., Wockhardt defaulted on its FCCBs in 2009. The company struggled for many years because of FCCBs. Singapore-based hedge fund QVT had approached the Bombay High Court in 2010 against Wockhardt.

Out of top 20 pharmaceutical companies, four companies namely Sun Pharma, Zydus Lifesciences, Ipca Labs, and Glenmark had undergone ECB in 2022-23. Lengthy minimum maturity requirements may effectively wipe out any short-term funding alternatives through the ECB route. ECB can be as secured loan or unsecured loan, and can be in difference currencies, e.g., Sun Pharma had ECB in the form of secured loan from Industrial Development Fund, Russia amounting to RUB 25 million, and it had unsecured loan in USD to the tune of US $16.7 mn, and in Japanese Yen to the tune of JPY 1,666.7 mn.

To mitigate foreign exchange risk, companies follow strategies which are broadly categorized as Internal Strategies, and External Strategies. Internal Strategies comprise (a) invoicing in local currency, (b) netting (involves linking or aggregating numerous financial responsibilities to determine the amount of net obligations), (c) matching as distinct from netting as netting relates to possible flows among group companies whereas matching includes third-party companies, and (d) leading (paying an obligation before the due date) and lagging (paying an obligation after the due date). External Strategies involve (a) hedging through Forward Contracts, (b) Hedging through Future Contracts, (c) Hedging through Currency Options, and (d) Hedging through Currency Swaps.

Pharmaceutical companies use forward contracts and currency swaps as tools to mitigate the foreign exchange risk. For example, Sun Pharmaceutical Industries Limited used Forward Contracts and Currency Swaps to mitigate FX risk while dealing with USD, ZAR, RUB, GBP, and EUR. Cipla used Forward Contracts and Option Contracts to mitigate FX risk while dealing with USD, ZAR, AUD, GBP, and EUR. For these two companies, key markets (currencies involved) remained US (USD), South Africa (ZAR), Russia (RUB), the UK, Australia (AUD) and Europe. Similarly, Dr. Reddy’s Laboratories, Ipca Labs used Forward Contracts as well as Option Contracts to mitigate forex risk. Companies like Divi’s Labs, Zydus Lifesciences, Aurobindo Pharma, Glenmark, Gland Pharma, Ajanta Pharma, Sanofi India did not carry out any commodity business and had not undertaken any hedging activities in FY23. Mankind Pharma dealt in various currencies but the company had not reported the use of any tool or technique to manage FX risk in their annual report for FY23.

Abbott, Lupin, JB Chemicals, and Laurus Labs used Forward Contracts to mitigate forex risk. Torrent Pharma also used Forward Contracts and Option Contracts. Another aspect is that amount associated with each currency varies according to the market in which the company operates.

The maximum amount associated with forex transactions of pharmaceutical companies from India for 2023 was US Dollar followed by Australian Dollar and Great Britain Pound (GBP). The US dollar’s supremacy in cross-border B2B payments is mostly due to its stability and liquidity. The use of dollar is a general trend and holds true for pharmaceutical sector too as this widespread acceptability means that businesses in a variety of nations are prepared to accept USD payments.

Macro-economic impact can be gauged from the fact that in 2023-24, India’s drugs and pharmaceuticals exports touched US $ 27.9 billion with a year-on-year increase of 9.67 per cent whereas in rupee terms, pharma exports from India for 2023-24 stood at Rs. 2.30 lakh crore with a year-on-year growth of 13 per cent as exports for 2022-23 stood at Rs. 2.04 lakh crore. Hence, exchange rate has the potential to provide or take away part of the growth in pharmaceutical sector. Hence, mitigation measures need attention.

Dr. Anil Kumar Angrish-Associate Professor (Finance and Accounting),

Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Isha Anand Tated–MBA (Pharm.), Department of Pharmaceutical Management,

NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.