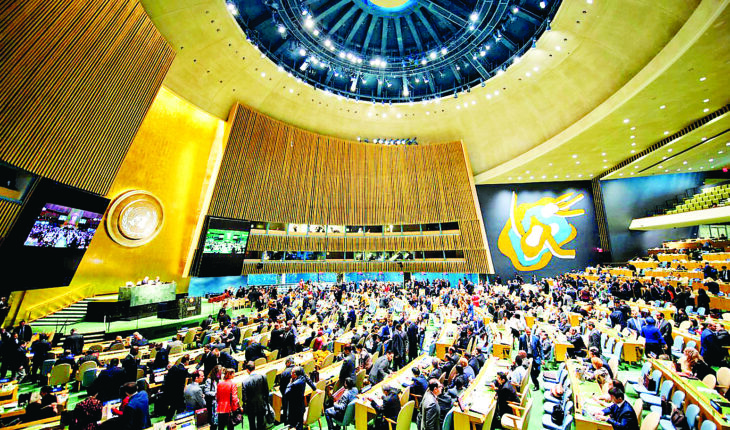

UNITED NATIONS : India’s economy could prove to be the “most resilient” in the subregion of South and South-West Asia over the long term, according to a report by the UN, which says a positive but lower economic growth post COVID-19 pandemic and the country’s large market will continue to attract investments.

The report titled ‘Foreign Direct Investment Trends And Outlook In Asia And The Pacific 2020/2021’, and compiled by United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), stated that inward FDI flows to South and South-West Asia slightly decreased by 2 per cent in 2019, from USD 67 billion in 2018 to USD 66 billion in 2019.

The growth, however, was mainly driven by India, which accounted for 77 per cent of the total inflows to the subregion and received USD 51 billion in 2019, up 20 per cent from the previous year.

The report, released last week, said the majority of these flows were destined for the Information and Communications Technology (ICT) and the construction of sub-sector.

Regarding the ICT sector, the report said the investment to India has evolved from information technology services for Multinational enterprises (MNEs) to the thriving local digital ecosystem where many domestic players, especially in e-commerce, have attracted considerable international investment.

The report added that FDI outflows from South and South-West Asia increased for the fourth consecutive year, modestly growing from USD 14.8 billion in 2018 to USD 15.1 billion in 2019.

The geographical spread of FDI outflows from the subregion remained uneven, with just two countries (India and Turkey) accounting for the vast majority of outflows in 2019, it said.

As such, the slight increase in outward FDI was predominantly due to an increase in outflows from India, which accounted for 80 per cent of total outward investment from the subregion, the report said, adding that in 2019, India invested USD 12.1 billion abroad, a 10 per cent increase compared with the previous year.

The report noted that in the short term, both inflows and outflows from and to the subregion are expected to decline.

In the first three quarters of 2020, the value of greenfield FDI inflows declined by 43 per cent compared to the same period last year, signaling a reversal of the growth trend in the subregion.

Most of the greenfield flows (87 per cent) were destined for India, although the overall greenfield inflows to the country declined by 29 per cent. Equally, FDI from India is projected to decline in 2020, with the largest MNEs revising their earnings down by 25 per cent in early 2020 due to the impacts of the pandemic.

However, India’s economy could prove the most resilient in the subregion over the long term. FDI inflows have been steadily increasing and positive, albeit lower, economic growth after the pandemic and India’s large market will continue to attract market-seeking investment, the report said.

India’s fast-growing telecom and digital space, in particular, could see a faster rebound as global venture capital firms and technology companies continue to show interest in the country’s market through acquisitions, it said.AGENCIES

The report titled ‘Foreign Direct Investment Trends And Outlook In Asia And The Pacific 2020/2021’, and compiled by United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), stated that inward FDI flows to South and South-West Asia slightly decreased by 2 per cent in 2019, from USD 67 billion in 2018 to USD 66 billion in 2019.

The growth, however, was mainly driven by India, which accounted for 77 per cent of the total inflows to the subregion and received USD 51 billion in 2019, up 20 per cent from the previous year.

The report, released last week, said the majority of these flows were destined for the Information and Communications Technology (ICT) and the construction of sub-sector.

Regarding the ICT sector, the report said the investment to India has evolved from information technology services for Multinational enterprises (MNEs) to the thriving local digital ecosystem where many domestic players, especially in e-commerce, have attracted considerable international investment.

The report added that FDI outflows from South and South-West Asia increased for the fourth consecutive year, modestly growing from USD 14.8 billion in 2018 to USD 15.1 billion in 2019.

The geographical spread of FDI outflows from the subregion remained uneven, with just two countries (India and Turkey) accounting for the vast majority of outflows in 2019, it said.

As such, the slight increase in outward FDI was predominantly due to an increase in outflows from India, which accounted for 80 per cent of total outward investment from the subregion, the report said, adding that in 2019, India invested USD 12.1 billion abroad, a 10 per cent increase compared with the previous year.

The report noted that in the short term, both inflows and outflows from and to the subregion are expected to decline.

In the first three quarters of 2020, the value of greenfield FDI inflows declined by 43 per cent compared to the same period last year, signaling a reversal of the growth trend in the subregion.

Most of the greenfield flows (87 per cent) were destined for India, although the overall greenfield inflows to the country declined by 29 per cent. Equally, FDI from India is projected to decline in 2020, with the largest MNEs revising their earnings down by 25 per cent in early 2020 due to the impacts of the pandemic.

However, India’s economy could prove the most resilient in the subregion over the long term. FDI inflows have been steadily increasing and positive, albeit lower, economic growth after the pandemic and India’s large market will continue to attract market-seeking investment, the report said.

India’s fast-growing telecom and digital space, in particular, could see a faster rebound as global venture capital firms and technology companies continue to show interest in the country’s market through acquisitions, it said.AGENCIES