Amidst the chilling cold of the last week of January, suddenly economic market sparked a heated discussions at local and global level. Around the same time every year, there is a lot of discussions for the upcoming union budget, but this time the scene was different. When a report presented by a foreign research company about one of India’s largest industrial group mentioning some financial fraud and manipulation, it took the form of global discussion on the one hand and on the other hand, it created a panic in the Indian stock market .The report started appearing everywhere as a breaking news and very soon different types of narratives of its analysis started coming on social media. It began to be felt that the impact of this report would surely be seen somewhere in the upcoming financial budget on February 1. It was definitely an economic setback for everyone. The only question in front of everyone was whether this too would be similar to the stock market scams of the 90s and its effect will be long lasting. Last year, a web series also refreshed us a lot about these scams. Thanks to the investors that nothing like this happened because India has definitely now taken the form of such a strong economy in which investors are mightier than big industrial house . In this context, if the data of world famous index- Sensex of Mumbai Stock Exchange is taken from January 24 to February 3, it will be found that market has corrected only by 137 points.

After the economic reforms of 1991, the Indian economy has taken a complete new turn towards capitalism. The stock market is playing its main role in this regard. Earlier the Indian economic system was not as strong as it is today. So whenever some financial scams of the stock market came into limelight ,its effect was seen in the Indian stock market for a long time as it would shatter the confidence of a common investor. Present scenario is completely different from this, therefore, directly linking the earlier economic scams of the stock market with the industrial group of the present time does not present the correct form of analysis. There are many grounds behind this. Mainly, it can be understood that in today’s time, the Indian economy is operating completely integrated with the global conditions, which was not there earlier. On the other hand, the facts of the former economic scams were opened by the unbiased journalists of India whereas this time it has been done by a foreign research company whose own credibility is at stake because its main motive behind exposing such investigation is to make profit for itself. This foreign research company, through its own investors, first sells large quantities of shares of big industrial groups and buys them when the price declines. It is technically known as short selling in terms of stock market. During this time, a positive fact that has come into the lime light is that the investors in the Indian stock market did not panic and kept their faith in the policies of the Indian economic system. This strengthened the Indian stock market, as a result of which it has now been established at the global level that India’s stock market is very strong and self-sufficient. The biggest support for the positive attitude of the Indian investor was definitely the attitude of the Indian economic system, in which there was no panic and no biased thinking towards the industrial group. This belief was further strengthened by the union budget of February 1.

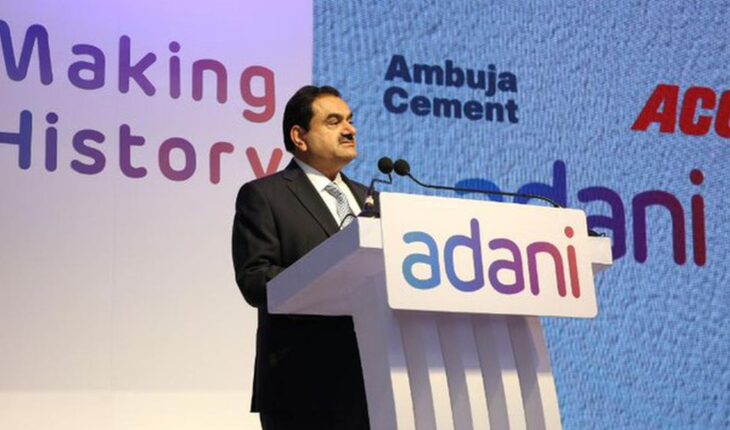

Since the report of a foreign agency has highlighted an industrial group of India, it is necessary to mention here that this group is involved in the business of such areas for a long time, in which it seems almost impossible to predict economic losses. This well-known industrial house has established itself in various business formats with complete monopoly. The apprehension seems to be completely biased that this industrial house will suffer commercial financial loss and will not be able to repay the various loans taken by it. It has to be understood that the movement of the Indian stock market and business activities are governed by different perspectives. It is not necessary that there should always be mutual coordination among them. In the last 10 days, there has been a loss of more than 50 percent in the stock market of this famous industrial house, due to which the share prices of various companies of this industrial house have declined hugely in Sensex of BSE and Nifty-50 of NSE. Its effect was also seen on Sensex and NSE Nifty in the initial days, but later both of them made a sharp recovery. It is also very important to clarify that the promoter’s personal participation in the shares of around 70 percent of the various companies of this industrial house is called promoter equity in technical language. And perhaps this is the reason that the promoter equity of the chairman of this company has also suffered a huge economic loss, due to which he is now out of the first 20 richest people in the world, whereas till 10 days ago he was the third richest person in the world. Now it is also to be understood that when the shares of these companies increased rapidly around 1000 percent in the last two years during the COVID-19 Pandemic, then perhaps for the same reason the personal wealth of the owner of this industrial house also went up very fast at the global level. He became one of the richest persons in India. It is also worth mentioning here that today, due to the fall in the stock markets of this industrial house, losses are being seen for other big investors like insurance, banks, etc. When the stock prices of this group rose multi-folds wouldn’t they have made profits during that time? Surely this is a matter of deep analysis, but it must be added to the fact that the fall of the stock market becomes an issue of economic concern only when it is being driven by the losses in the business activities of the company.

Hindenburg, a foreign company, which made various types of economic allegations through 88 questions in a 3200-word report on India’s industrial house, has suddenly come into the limelight at the global level in the recent past. It is worthwhile to mention here that it is a common business activity of this foreign research company to bring the internal financial information of any company to global discussion and through short-selling in the shares of that company makes huge profits for its investors. This research company mentions all this in its own official documents. It is a business model of the company. It is also very important to mention here that the name of this company, Hindenburg, is based on an air-crashed plane in Germany about 100 years ago, in which 100 people lost their lives due to excessive use of hydrogen. It is known today as a man made phenomenon. The company actually came into existence in 2017 and till now has exposed the internal financial facts of many companies globally. There is no official information about this company on the internet such as declaration of its registered office, etc.

In the midst of all this, the most positive fact which has emerged is that in the past it was definitely said that the Indian stock market is not a main source of development of the Indian economy, but these days it has gained a lot of attention that the Indian stock market runs parallely with the growth of the Indian economy. It has also been confirmed, in the last 10 days, that the investors have maintained their confidence in the share market.

Now it is also proved that the most important objective for the investor is the safety of their capital investment and he is aware that the Indian capital market does not behave negatively immediately like other capital markets of the world. It is also very important to highlight that many Indian investors, in the last 10 days, have made a lot of profit even in the huge fall in the share prices of this big industrial house.

Dr. P.S. Vohra , Academician, Financial Thinker & Newspaper Columnist , Views are personal