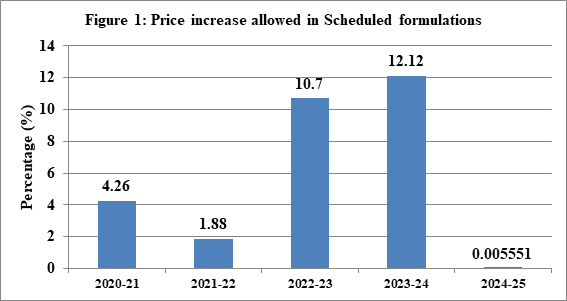

Revision in the prices of scheduled formulations on yearly basis in India seeks to reimburse manufacturers for the increase in input costs due to inflation. Any hike in prices of medicines prompts debate on price control of pharmaceuticals, and linkage of inflation with pharmaceutical prices. Manufacturers of scheduled formulations have been allowed an increase of (+) 0.005551% during the calendar year 2023 over the corresponding period in 2022 through Office Memorandum dated March 27, 2024 by National Pharmaceutical Pricing Authority (NPPA). Hike in prices of scheduled formulations is allowed as per the paragraph 16 (2) of the Drugs (Prices Control) Order, 2013. Scheduled formulation means any formulation which is included in the First Schedule of DPCO, 2013. National List of Essential Medicines (NLEM) which is published by the Ministry of Health and Family Welfare as updated and revised from time to time is included in the First Schedule of the DPCO, 2013. Annual hike in prices is based on the Wholesale Price Index (WPI) data which is provided by the Office of the Economic Advisor, Department of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry. Paragraph 16 of the DPCO provides for revision of the ceiling prices of scheduled formulations as per the annual WPI for preceding calendar year on or before April 1 of every year. It is not that only increase is allowed. In case of decline in the WPI, there shall be a corresponding reduction in the maximum retail price (MRP).Within a period of 45 days; manufacturers have to ensure the compliance of the notification regarding the revised ceiling price. This provision essentially covers impact of inflation.

Paragraph 19 of DPCO, 2013 empowers government to allow an increase or decrease in the ceiling price or the retail price, as the case may be, irrespective of annual wholesale price index for that year. This provision is for fixation of ceiling price of a drug under certain circumstances, i.e., extraordinary circumstances. For example, in July 2021, the NPPA had allowed a one-time increase of 50 per cent in the ceiling prices of nine scheduled formulations of three drugs namely ibuprofen, carbamazepine, and ranitidine, to ensure their availability thereby not forcing the public to switch to costly alternatives. Upward price revision was allowed as these formulations were low-priced drugs. It was an exceptional measure as advised by the Standing Committee on Affordable Medicines and Health Products (SCAMHP). For this purpose, the NPPA invoked extraordinary powers in public interest under Para 19 of the DPCO. The Government also monitors the MRP of all the drugs, including the non-scheduled formulations. Under Paragraph 20 of DPCO, 2013 the government ensures that no manufacturer increases the MRP of a drug more than ten per cent of the MRP during preceding twelve months.

The WPI rate of (+) 0.005551% for the current fiscal is the lowest in last six years. Hike was in double digits in previous two years, i.e., 12.12 per cent in 2022 which came into effect on April 1, 2023, 10.7 per cent in 2021 which came into effect on April 1, 2022. For the year 2020, 2019 and 2018, it was 1.88 per cent, 4.26 per cent, and 3.43 per cent respectively. Like any other industry, the pharmaceutical industry has to face price rise in raw materials, packaging cost, transportation cost, and increase in manufacturing costs. Essentially, it is a reimbursement for the increase in input costs. If the price does not cover inflation then it has implications for the quality of products as well as steady supply of essential medicines in the country. From the regulatory perspective, it is pertinent that drug price ceilings are not violated, and even non-scheduled drugs remain affordable.

For 2023, inflation remained the top concern for the pharmaceutical industry as per a poll of executives that was conducted by GlobalData Healthcare. Countries have their own mechanism to factor inflation in pricing of pharmaceutical products. The U.S.A. is the largest pharmaceutical market in the world. Inflation became a concern in the U.S.A. in recent years. In January 2022, inflation in the USA rose to 7.5% which was the highest year-on-year rise since February 1982, i.e., highest in 40 years. In the U.S., the Inflation Reduction Act that came into effect on August 16, 2022 had specifically provided for pharmaceutical products. A report authored by Arielle Bosworth et al. (2022, September 30) tracked drug price changes from 2016-2022. From July 2021 to July 2022, the prices of 1,216 medications in the U.S. exceeded the inflation rate of 8.5 per cent. The average price increase for these 1,216 medications was 31.6 per cent. Not only that, there were some drugs for which the increase was of more than 500% in 2022. In this background, the Inflation Reduction Act introduced a new requirement for manufacturers to pay rebates to Medicare for Part D drugs whose price increases exceeded inflation, starting from October 1, 2022. Medicare Part D, the prescription drug benefit, is the part of Medicare which covers most outpatient prescription drugs. Medicare offers coverage for Americans who are above the age of 65, or those who are younger with specific health conditions.

Europe is also facing similar concerns regarding inflation and impact on medicine prices. Medicines for Europe Executive Committee highlighted the concern through writing to Health Council that comprises European Union Ministers for Health. In an Open Letter dated June 9, 2022, it expressed the concern over the impact of ‘rampant inflation’ on the secure supply of essential medicines for European patients. Medicines for Europe represented the pharmaceutical industry that supplied close to 70 per cent prescription medicines at very low cost to EU healthcare systems. In the letter, it highlighted higher inflation rate (over 7 per cent) in Europe, a level which has not been seen for decades along with external factors which exacerbated cost inflation for pharmaceuticals. External factors cited included ‘energy costs and supply’ due to the war in Ukraine (65% increase in gas prices and 30% increase in electricity), logistics (increase of up to 500% due to the bottlenecks caused by the Covid-19 pandemic and war in Ukraine), inputs and raw materials (rise between 50-160%), and skilled human resources (skill shortage for specialist science-based industry). Through this letter, industry representatives expressed inability to operate in an environment combining rampant cost inflation with policies that continuously lower prices. They asked for adopting measures so that companies should be able to adjust prices to the level of inflation.

In Pakistan, our neighbouring country which is the fifth-most populous country, the government approved a 14 per cent increase for essential medications, and a 20 per cent hike for non-essential drugs in September 2023. This move caused the shortage and disappearance of over 200 medications which included life-saving and essential drugs. Ongoing inflation and fall in the value of their currency has affected pharmaceutical industry as well as patients in Pakistan. In March 2023, annual inflation in the country was 35%, and the Pakistan Pharmaceutical Manufacturing Association (PPMA) along with other industry associations had demanded a hike of 39% across-the-board.

Sri Lanka faced economic crisis in 2022 and in April 2022, the Sri Lankan government was not left with any option other than to increase the prices of antibiotics, certain painkillers and medications for heart conditions by almost 40 per cent. Prices of certain drugs rose by 97%. In April 2023, inflation was 25.2% in Sri Lanka, and with little reduction in inflation and easing of economic crisis, Sri Lanka could reduce prices of 60 essential drugs by 16% from June 15, 2023. At present, price cap in Sri Lanka is imposed by the National Medicines Regulatory Authority (NMRA) on 60 medicines only out of about 1,200 medicines available in the country. Prices of other medicines have seen an increase of 600-800%. In March 2024, All-Island Private Pharmacy Owners’ Association (AIPPOA) had urged the government to abolish price controls on 60 specific medicines and also, to adopt a unified pricing mechanism based on the Cost, Insurance, and Freight (CIF) values. In Sri Lanka, the price of all medicines have been revised thrice since 2021, i.e., 9% increase in 2021, and revision of 29% and 40% in 2022. Revision was mainly attributed to drastic devaluation of their currency in 2021. Due to economic crisis, devaluation of currency and inflation, pharmaceutical prices have remained higher in Sri Lanka. In April 2024, inflation rate in the economy was just 1.5 per cent as per the Colombo Consumer Price Index (CCPI) but prices of pharmaceutical products remained higher as Sri Lanka heavily relies on imports. By October 2022, Sri Lanka relied on imports for about 85% of its pharmaceutical requirements and about 80% of its medical supplies.

In Bangladesh, the Consumer Association of Bangladesh (CAB) filed a petition in April 2024 with the High Court for seeking direction to the Secretary of Health Services Division and the Directorate General of Drug Administration (DGDA) in ‘not fixing the price of all drugs’ under Section 30 of the Drugs and Cosmetics Act, 2023. The CAB cited a media report published on March 11, 2024 which said that medicine prices rose 7 to 140 per cent in two weeks. In January 2024 too, representatives of the Bangladesh Association of Pharmaceutical Industries (BAPI) conveyed to government authorities that drug production costs had increased by up to 30% in 2023 in addition to increase in gas, transportation, and operational costs, and still, DGDA chose not to raise medicine prices. Depreciation of domestic currency against US dollar (from $=TK84 to $=TK130) also contributed to increase in prices as 97% of raw materials are imported. They expressed apprehension of potential shortages and a decline in the quality of drugs in absence of hike in drug prices. Prices of 53 essential drug brands across 20 generics were raised in the range of 13% to 75% by the DGDA in 2022. In Bangladesh, 308 pharmaceutical companies produce allopathic medicines with more than 27,000 brands of more than 1,500 drugs. 219 drugs are categorized as ‘essential’, and the government regulates prices of 117 of these essential medicines.

Lower hike in prices for scheduled formulations for 2024-25 has provided some relief for patients in India. At present, the ceiling prices on 923 medicines are effective. If WPI factor is considered for 2024 then there will be no change in the existing ceiling prices for 782 medicines till March 31, 2025. It is worthwhile to note that manufacture of pharmaceuticals; medicinal chemical and botanical products have overall 1.99 per cent weightage in WPI. Due to lower WPI in India, manufacturers of scheduled formulations can cater to overseas demand in a competitive manner as inflation is likely to remain elevated in many economies across the globe. To conclude, pharmaceutical pricing authorities in different countries need to strengthen their pricing mechanism so as to factor inflation appropriately through pharmaceutical sector specific indices. This move can bring transparency in compensating the increase in input costs.

Dr. Anil Kumar Angrish,Associate Professor (Finance and Accounting),Department of Pharmaceutical Management, NIPER, SAS Nagar (Mohali), Punjab.

Disclaimer: Views are personal and do not represent the views of the Institute.