JSW Steel Limited highlighted its highest-ever quarterly production, Sales, EBITDA and PAT in Q32017-18 in standalone and consolidated performances. Its’ standalone with ‘highest-evers’ included: Crude Steel production of 411 million tonnes (up by 7% y-o-y); Saleable Steels sales of 3.97 million tonnes (9% y-o-y growth); Operating EBITDA of Rs 3,573 crore (29% y-o-y growth) and PAT of Rs 1,126 crores (37% y-o-y growth), besides Revenue from operations at Rs 16,453 crores (13% y-o-y growth.)

The company’s quarterly consolidated performance included highest-ever: Saleable steel sales at 4.03 million tonnes (12% y-o-y growth), Operating EBITDA at Rs 3,851 crores (37% y-o-y growth), PAT at Rs 1,774 crores (148% y-o-y growth) and Revenue from operations at Rs 17,861 crores (17% y-o-y growth).

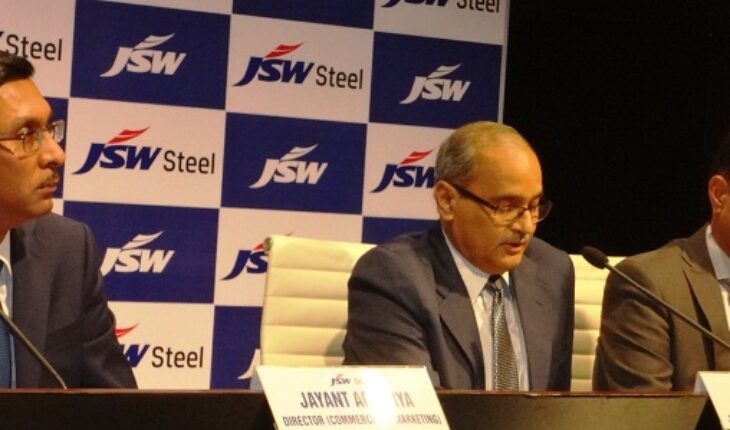

Crediting its highest-ever quarterly crude steel production of 4.11 million tonnes due to enhanced operational efficiencies at its Dolvi works and improved water availability at its Salem works in Tamil Nadu, Seshagiri Rao M.V.S., Joint Managing Director and Group CFO, said here today that the company focused on increasing exports sales volume (up 24% q-o-q), especially on long products, to leverage upon a robust demand and pricing environment in international markets – thus leading to a liquidation of stocks sequentially.

The company remained focused on enriching the product mix and the overall sales of value-added and special products grew by 8% y-o-y (accounting for 57% of total sales, he said, while noting that the quarterly volumes of JSW Coated Products were impacted by planned shutdown of its two Galvanizing lines at Tarapur works for maintenance and revamping to enhance production capacities, while Spreads were impacted by delayed transmission of higher substrate prices.

The U.S.-based Plate and Pipe Mill facility produced 59,623 tonnes of Plates and 15,109 net tonnes of Pipes with capacity utilization of 24% and 11% respectively in this quarter, where sales volumes were 41,486 net tonnes of Plates and 16,044 net tonnes of Pipes, he said.

Replying to questions, he said the outlook for emerging economies in the global arena is positive except in China which witnessed increased production but declining exports. “The steel industry is expected to do better and the Q4 is always the best quarter. However, iron ore prices in India are +completely out of tune+ and the steel industry is suffering due to imposed duties — which should be uniformly applied. Around 30 million tonnes steel exports are expected this year and we hope iron ore prices will come down,” he added.

Exceptional items during the Quarter included: provision of Rs 264 crores made for impairment towards Goodwill, Mining development and advances relating to surrender of one of its iron ore mines in Chile, which have been recognized based on estimates.; and following enactment of Tax Cuts and Jobs Act by the USA on December 22, 2017 in which corporate income tax rate was reduced to 21%, the Group recognized a reversal of deferred tax liabilities of Rs 572 crores for the US businesses, Seshagiri Rao said.

The Net Debt decreased by Rs 696 crores to Rs 42,068 crores by December-end 2017 and the weighted average interest rate decreased by 23 bps (q-o-q) to 7.03%.

Meanwhile, global growth is firming up with a broad-based recovery across emerging and developed markets. The USA economy continues its strong performance with acceleration in industrial activities and the recent changes in the tax policy are expected to boost activities and investments within the country and for its trading partners. The Euro area remains on a strong footing with all the major economies in the region showing a good growth, supported by a pick-up in trade.

World crude steel production was up by 5.3% in CY2017 to 1.691mt as production increased in almost all the major regions. As per WSA’s October-16 forecasts, world steel demand is expected to grow by 1.6% in 2018, while the world-ex China demand is expected to grow by 3%. Given the strong underlying economic performance across the globe, there appears to be an upside to these demand projections for 2018. Steels prices across all the regions are buoyant and firm raw material prices are supportive. Chinese steel exports have declined by 31% in CY2017 and have eased the supply pressure across various global markets, lending a support to price stabilization amid improving demand.

India’s steel demand growth improved in 3QFY2018 – largely due to the base effect. However, steel consumption is expected to grow strong on the back of the Government’s push for infrastructure-spending and strengthening consumer demand. While steel imports into the country have moderated in recent months, YTD import of flat products increased by 16% y-o-y. Import of coated products continues at an elevated level, pressurizing domestic manufacturers, but increasing by a staggering 250% y-o-y. Imports from Korea, China and japan constituted 70% of total imports. Indian domestic steel prices are still lagging behind international prices. A sharp increase in raw material prices has put a tremendous pressure on costs. However, increase in steel prices should alleviate the cost impact to some extent, according to the Group’s Outlook report.