New Delhi : In its latest meeting for FY24, the six-member Monetary Policy Committee (MPC) has voted by a majority of 5:1 to maintain the repo rate at 6.50 per cent, as retail inflation persists above its four percent target.

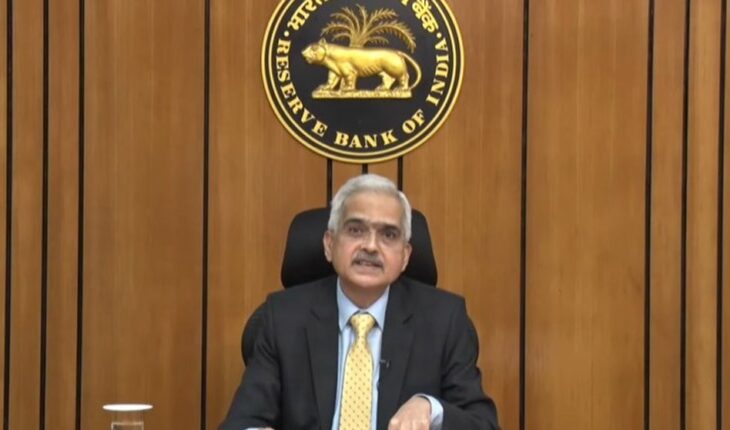

The meeting was held on Thursday, chaired by Shaktikanta Das, Governor, Reserve Bank of India (RBI).

This decision marks the sixth consecutive meeting where the MPC has opted to keep the repo rate unchanged. The repo rate serves as the interest rate at which banks access funds from the Reserve Bank of India to address short-term liquidity imbalances.

Additionally, the committee, with a majority of 5:1, has agreed to sustain the monetary policy stance, focusing on withdrawing accommodation to ensure inflation progressively aligns with the target while fostering growth.

Retail inflation rose to a four-month high of 5.69 per cent in December 2023, primarily driven by an increase in food prices compared to 5.55 per cent in November.