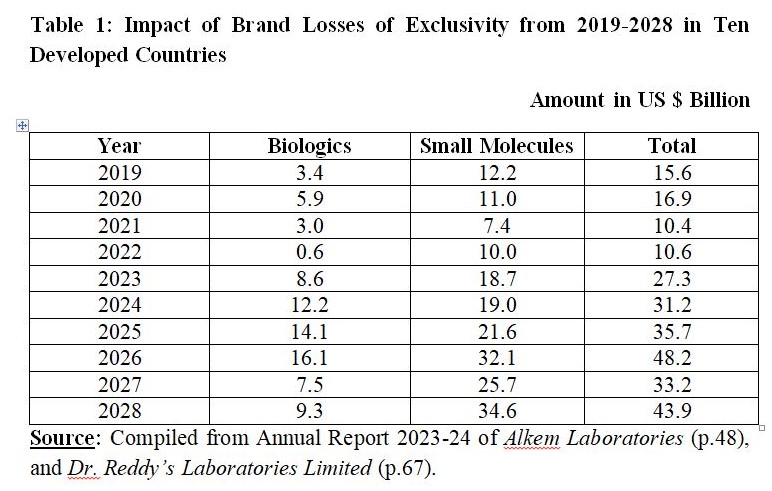

Till 2028, spending on innovator drugs is likely to face a reduction of about US $146 Billion due to patent expiry. This will apply to ‘small molecule’ as well as ‘biologics’, and their respective reduction in spending is likely to be $106 Bn and $40 Bn as Losses of Exclusivity (LOE) has direct impact on brand spending as generic players. Patent cliff has implications for large cap companies as these companies will continue to face patent cliffs. For example, Merck had full year worldwide sales of $64.2 Billion for 2024 which was an increase of 7 per cent from Full Year sales of 2023. KEYTRUDA sales touched $29.5 Billion with a growth rate of 18.0 per cent. Sales from KEYTRUDA alone were 45.95 per cent of total sales of the company, and growth rate was also higher as compared to company’s overall sales growth. KEYTRUDA faces a key patent expiry in 2028. Because of this reason, Rob Davis – the company’s CEO stated that acquisitions valued up to $15 billion would be in Merck’s range. Hence, patent cliffs as well as gaps in the pipeline of global pharma MNCs in the latter half of this decade will compel these companies to look for M&A opportunities to achieve their growth plans.

This is not the first time that Indian companies got this opportunity to capitalise. Impact of Brand Losses of Exclusivity decide the size of opportunity, e.g., during 2014-2016, about US $92 bn worth of patents drugs were expected to go off patent in the USA in comparison to US $65 bn during 2010-12. Factors which play role include aggressive filings of ANDAs, Para – IV filings (where generic company gets exclusive rights to sell generic version of patented drug for certain period), capitalizing on the patent expiries of blockbuster drugs. Product portfolio of pharmaceutical companies, filings, along with necessary manufacturing infrastructure are also deciding factors.

Dr. Reddy’s Laboratories (DRL) Limited and Alkem Labs quoted IQVIA Market Prognosis (2023, September), and Global Use of Medicines, 2024: Outlook to 2028, Report by the IQVIA Institute for Human Data Science. DRL also cited two more reports including 2023 Global Life Sciences Outlook by Deloitte, and World Preview 2023 by Evaluate Pharma.

From 2019 to 2024, exclusivity losses were estimated to the tune of $112.0 Billion comprising Biologics worth $33.7 Billion and Small Molecules worth $78.3 Billion. From 2025 to 2028, it is estimated that exclusivity losses are likely to be $161.0 Billion comprising Biologics worth $47.0 Billion and Small Molecules worth $114.0 Billion.

Losses of exclusivity represent a huge opportunity for Indian pharmaceutical companies. Due to tariffs, Indian pharmaceutical companies are at the receiving end to some extent, but Loss of Exclusivity presents a major growth opportunity for these companies to launch generic versions. It should be seen in the background that Indian companies cater to about 40 per cent of the total demand in the generic drug market of the USA.

The major factor that goes in the favour of Indian pharmaceutical companies is their focus on Research and Development for products in this important market. Their coverage of therapeutic categories such as cardiovascular, anti-cancer, and anti-diabetic, also reflects their breadth of product portfolio. Major pharmaceutical companies recognize this opportunity and are well placed to take advantage from this. It can be observed from the fact that the US Food and Drug Administration (US FDA) approved 618 Abbreviated New Drug Applications (ANDAs) during January-September 2023. ANDAs contains data that is submitted to FDA for the review and potential approval of a generic drug. Out of these 618 ANDAs, Indian pharmaceutical companies and their subsidiaries secured 284 ANDA approvals, i.e., 46 per cent of total.

Sun Pharmaceutical Industries Limited has established itself in this space since its entry in the US market through acquisition of Caraco in 1997. In FY24, topline growth of the company was led by the US market with 13.4 per cent Year on Year (Y-o-Y) growth. As on March 31, 2024, the company had 635 cumulative ANDAs filed and 531 cumulative ANDAs approved with rest pending with the US FDA for approval. US business had contributed 32 per cent to the company’s consolidate revenues. The company has emerged as the 13th largest generics pharma company in the US and secured the second position by prescriptions in the U.S. dermatology market. Diverse portfolio also favours the company as it has expanded footprint in the Specialty Segment, and now, focuses on dermatology, ophthalmology, and onco-dermatology.

By March 31, 2024, Cipla Limited had 298 patents, 277 cumulative ANDAs and NDAs along with 2,204 cumulative DMFs. Besides Indian R&D facilities, the company has R&D facility in New York, USA. ANDAs and NDAs included those with InvaGen Pharmaceuticals Inc., a wholly owned subsidiary of the company. Further, portfolio of ANDAs included approved (158), tentatively approved (20), and under approval (77). For FY24, 12 ANDAs were filed and 5 were approved. NDA portfolio included approved (6), tentatively approved (12), and under approval (4).

Lupin Limited had 442 ANDAs and NDAs filed with the U.S. FDA up to March 2024. The company is also well placed to tap the opportunity arising out of patent cliff given the fact that the company is ranked 3rd in the U.S. (by prescriptions) and 11th largest generics company in the world. Lupin had 12 ANDA and ANDSs (in Canada) filings in FY24 which were lower than previous years’ figure, i.e., 28 filings in FY23, and 19 filings in FY22. But ANDA approvals stood at 42 in FY24 as compared to 17 in FY23 and 9 in FY22. Cumulative approvals of ANDAs alone for Lupin stood at 314 out of 431 filings.

As on March 31, 2024, Dr. Reddy’s Labs had 325 cumulative ANDAs, and 86 filings were pending approval including 81 ANDAs and 5 NDAs. In FY24, the company filed 17 new ANDAs with the US FDA. It was further highlighted by the company that out of 86 ANDAs, 50 were Para IV applications, and the company believed that 24 out of these had the ‘First to File’ status. DRL had a revenue of Rs. 245.5 bn from Global Generics in FY24, with a growth rate of 15.0 per cent as compared to FY23. North America Generics (NAG) had an impressive growth of 28.0 per cent in FY24 over FY23 even though the growth was aided by the strengthening of the US currency against Indian rupee. Global Generics had contributed 88.0 per cent to the company’s overall sales in FY24. North America Generics is the largest market for DRL as it contributed about 53.0 per cent (Rs. 129.9 bn or approx. US$ 1.6 bn) to the company’s Global Generics sales, and 47.0 per cent of overall sales.

By FY24, Alkem Labs had 176 ANDAs besides 2 New Drug Applications (NDAs) with the US FDA. It had approvals of 145 ANDAs (including 13 tentative approvals. The Company had 1 manufacturing facility in the US.

Recent news on tariffs for pharmaceuticals from India has implications for competitiveness of Indian pharma companies so patent cliff due to loss of exclusivity in recent years and forecast for next four years is promising for Indian pharmaceutical companies. Given the depth and breadth of portfolio of Indian pharmaceutical companies and their focus on the U.S. market, many Indian pharmaceutical companies are well placed to perform well.

Dr. Anil Kumar Angrish, Associate Professor (Finance and Accounting), Department of Pharmaceutical Management,NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.