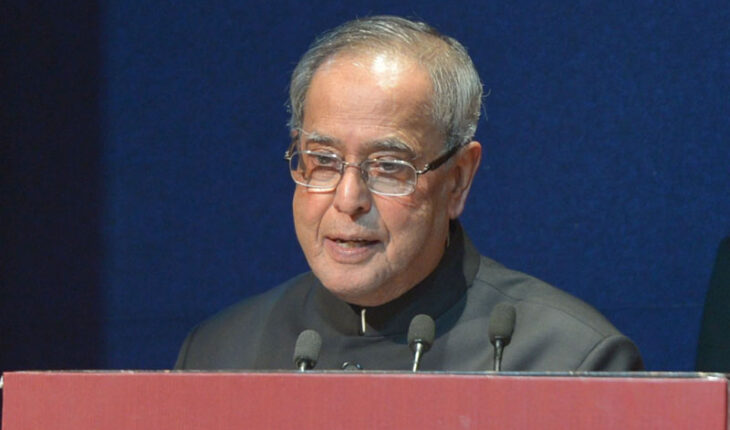

New Delhi, Apr 13 (PTI) President Pranab Mukherjee has given assent to four key legislations on Goods and Services Tax (GST), paving the way for the roll out of one-nation-one- tax regime from July 1.

New Delhi, Apr 13 (PTI) President Pranab Mukherjee has given assent to four key legislations on Goods and Services Tax (GST), paving the way for the roll out of one-nation-one- tax regime from July 1.

The legislations were The Central GST Act, 2017, The Integrated GST Act, 2017, The GST (Compensation to States) Act, 2017, and The Union Territory GST Act, 2017, officials said today. These bills were passed in Rajya Sabha on April 6 and by Lok Sabha on March 29. The GST, the biggest taxation reform since Independence, will subsume central excise, service tax, Value Added Tax (VAT) and other local levies to create an uniform market. The Central Goods and Services Tax Act, 2017, provides for the levy of the Central Goods and Services Tax by the Centre on the supply of goods and services within the boundary of a state. Whereas, the Integrated GST Act deals with the levy of Integrated Goods and Services Tax by the Centre on inter-state supply of goods and services. The Goods and Services Tax (Compensation to States) Act, provides for compensation to the states for the loss of revenue arising on account of implementation of the Goods and Services Tax. The Union Territory GST Act makes a provision for levy and collection of tax on intra-state supply of goods, services or both by the Union Territories. The GST rates are to be discussed by the GST Council headed by Finance Minister Arun Jaitley on May 18-19. Jaitley had in Rajya Sabha last week said that the GST Council, comprising finance ministers of Union and states, had agreed to take a decision on bringing real estate within the ambit of the new tax regime within a year of its roll out. The GST Council will also take decisions regarding inclusion of petroleum products and alcohol in the GST network, one by one, in the foreseeable future. As regards Jammu and Kashmir, the Finance Minister had said the law will not apply there because of Article 370 that gives special status to the state. Jammu and Kashmir will have to legislate its own law and integrate with the GST regime, Jaitley had said.