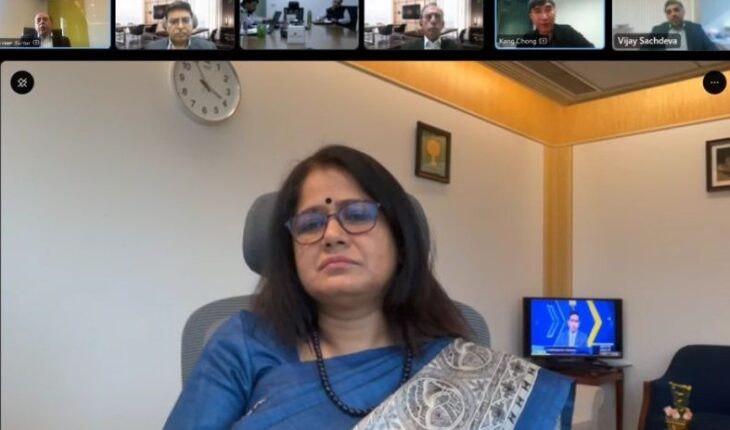

New Delhi: In her special address at the ASSOCHAM virtual session on Risk Management and Internal Control, Yatri Dave Vitekar, IRPS Chief Vigilance Officer Securities and Exchange Board of India said In a regulatory landscape where public trust is paramount, anyone handling public money has an inherent duty to act as a public servant, ensuring transparency, accountability, and ethical governance. The increasing volume of complaints—both public and private—highlights the urgent need for robust preventive mechanisms. Establishing strong systems for oversight and compliance is not just a regulatory mandate but a commitment to fostering a corruption-free environment where financial integrity and public confidence remain uncompromised. Adhering to SEBI regulations not only mitigates financial and compliance risks but also strengthens corporate governance, fostering long-term sustainability and market integrity.

There is a need to set up internal control systems to avoid corruption and malpractices. In today’s evolving financial landscape, regulatory compliance is not just a requirement but a cornerstone of trust and stability. SEBI’s stringent framework ensures transparency, accountability, and investor protection, compelling businesses to adopt robust risk management and internal control measures. Recognizing potential risks that may impact operations, financial reporting, and compliance is the way put it.

Sim Keng Chong Partner, Foo Kon Tan Advisory Services Pte Ltd, Singapore spoke about Effective risk management which is the backbone of strong corporate governance. By integrating the COSO Framework, he further said that organizations can proactively identify, assess, and mitigate risks across financial, operational, and compliance areas. A robust internal control system—built on clear objectives, structured risk assessment, and continuous monitoring—ensures transparency, strengthens accountability, and safeguards business integrity in an ever-evolving landscape. Top-level management reviews to oversee internal controls should be regularly organized.

In his inaugural address Naveen Aggarwal Co-chairperson, ASSOCHAM National Council for Internal Audit & Risk Management; and Co-Managing Partner, S S Kothari Mehta, and Co. LLP focused on multiple risks in corporate governance from ethical to technological to regulatory to financially. These complaints should be perceived with clarity and authenticity. Reputational risk should be accounted for, he said.

Vijay Sachdeva Co-chairperson, ASSOCHAM National Council for Corporate Affairs, Company Law, and Corporate Governance; and Head of Risk Management & Internal Audit, Chambal Fertilisers, and Chemicals Limited gave his concluding remarks sharing the role of internal control system to safeguard interests of stakeholders and interest of company.