New Delhi: The 35 basis points (BPS) increase in the policy rate by RBI is on the expected lines, though there is a signal that the rate hike intensity is being softened, apex industry chamber ASSOCHAM said.

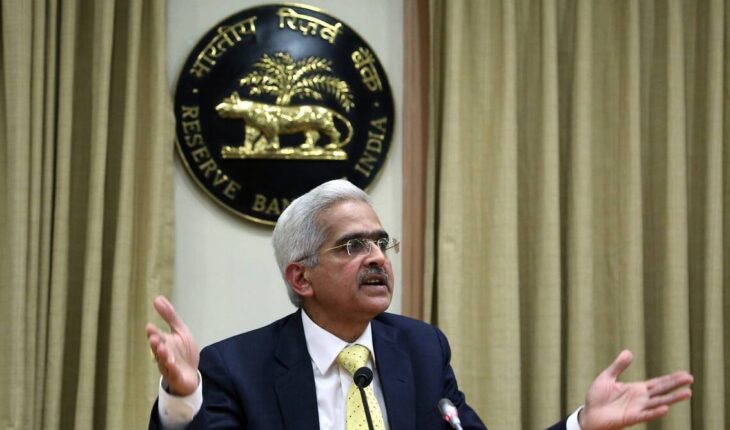

”The rate hike is as per our expectations. In fact, ASSOCHAM had suggested a band of 25-35 BPS and the Monetary Policy Committee has maintained that band. Given the global macro-economic scenario and the inflationary pressure, hardening of the benchmark interest rate was unavoidable. RBI Governor Shaktikanta Das’ assurance that the central bank would ensure adequate liquidity in the system is reassuring for the industry and trade.” ASSOCHAM President Sumant Sinha said.

”While the hike in the REPO rate by 35 BPS to 6.25 % was given, RBI’s focussed attention on taming inflation would eventually deliver us a sustainable economic growth. Despite the challenges in the global economy and uncertainties with regard energy prices, supply chain and geo-political situation, India remains amongst the fastest growing economies of the world, as elaborated by RBI Governor Shaktikanta Das. Going forward, ASSOCHAM expects the Indian economy to grow close to seven per cent,” chamber Secretary General Deepak Sood said.

The optimism is borne out by double digit growth in credit expansion for the last eight months. However, this growth in credit can be made sustainable if the lending rates are not increased any further. ASSOCHAM expects the unfolding scenario on these lines.

The chamber also welcomed other policy measures like introduction of single-block-and-multiple-debits functionality in UPI and hedging facility for gold exposure to Indian entities in the international market.