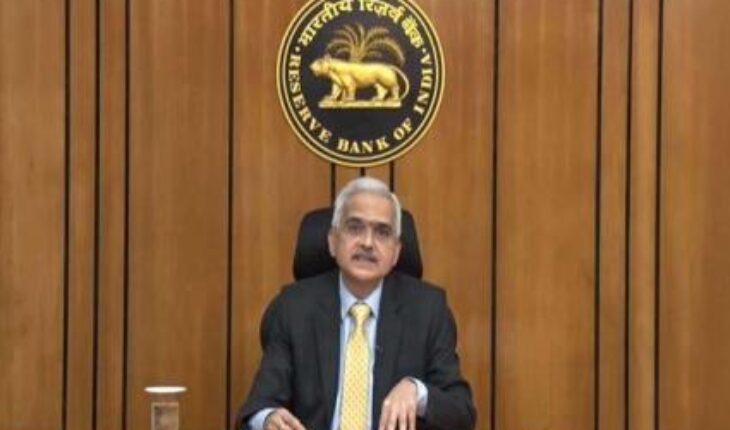

Mumbai : The Reserve Bank of India on Friday decided to keep policy rate unchanged for the seventh time in a row and said that it remains vigilant towards upside risks to food inflation.

The rate increase cycle was paused in April last year after six consecutive rate hikes aggregating to 250 basis points since May 2022.

Announcing the first bi-monthly monetary policy for the current financial year, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 6.5 per cent.

He said MPC will remain watchful of food inflation.

The six-member rate-setting panel by a majority vote of 5:1 favoured the status quo on interest rate, while maintaining focus on withdrawal of accommodative stance.

In February, the Consumer Price-based Inflation (CPI) stood at 5.1 per cent.

The government has mandated RBI to ensure CPI inflation at 4 per cent with a margin of 2 per cent on either side.