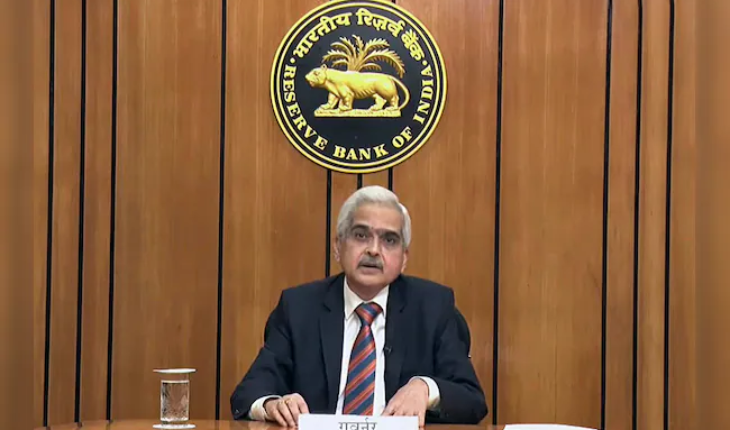

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das has raised serious concerns regarding the misreporting of customer grievances by private sector banks, criticising the practice of classifying complaints as mere queries.

In a keynote address at the Conference of Directors of Private Sector Banks in Mumbai, Das called on private lenders to adopt a more transparent and customer-centric approach, ensuring that genuine complaints are appropriately handled and escalated when necessary.

MSME bodies have been alluding to a dysfunctional grievance redressal mechanism in banks.

Federation of Indian Micro and Small & Medium Enterprises (FISME), the national MSME body, has repeatedly raised the issue.

“It is not just private sector banks, in all commercial banks grievance redressal system is broken. There is no time bound grievance handling system and a escalation matrix displayed anywhere on websites. It is very frustrating to MSME clients”, says Neeraj Kedia Chairman of Banking Committee of FISME.

“It is disheartening to see complaints being misclassified, undermining the very foundation of customer trust,” said Das. He emphasised the importance of robust grievance redressal mechanisms, urging banks to properly escalate unresolved complaints to internal ombudsmen.

Highlighting instances where grievances were rejected without due escalation, he urged bank boards and customer service committees to scrutinise these practices, underscoring the need for a sincere commitment to customer-centricity.

Das also expressed concern over the growing trend of banks viewing service charges and penalties as profit avenues. He noted that when these charges are imposed without transparency or are part of forced product bundling, it risks eroding trust between the bank and its customers.

“Boards should give a close look at service charges and penalties, particularly when they are treated as profit-making tools or when there is selective disclosure to customers,” he cautioned.

During the conference, which was attended by over 200 directors fr0m private banks, including chairmen, managing directors, and CEOs, Das stressed that banks must move beyond a profit-driven mindset.

He also pointed to gaps in financial literacy, especially among rural and marginalised populations, who are more vulnerable to exploitative lending practices.

To address this, he called on banks to enhance their outreach and educational efforts to safeguard these groups fr0m potential financial harm.

Das concluded by urging stronger governance and ethical conduct within the banking sector, warning that unethical practices, including misselling of products, could lead to long-term reputational damage and regulatory scrutiny.

“Fair lending practices and strong grievance redress systems are critical to protecting customers’ interests,” he said, emphasizing that transparency and accountability must remain at the core of banking operations.

The governor’s remarks come as part of the RBI’s ongoing efforts to ensure that private sector banks maintain high standards of customer service and ethical conduct.