New Delhi : In a significant monetary policy decision, the Reserve Bank of India (RBI) has maintained its key policy rates for the tenth consecutive meeting while shifting its stance from ‘accommodative’ to ‘neutral’.

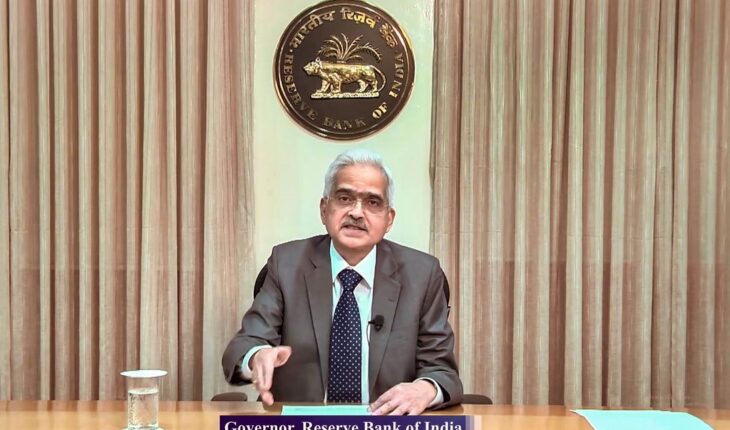

This announcement was made by RBI Governor Shaktikanta Das on October 9, signalling a potential openness to future rate cuts.

The decision comes amid ongoing inflationary pressures and concerns over possible escalations in the Middle East crisis, which could lead to increased commodity prices.

The repo rate, the short-term lending rate, remains unchanged at 6.5 percent, a level it has held since February 2023. Experts anticipate that any easing of rates may not occur until December at the earliest.

RBI Deputy Governor Michael Patra emphasised the bank’s cautious approach, stating, “We want to see off the current hump in inflation before considering next move on rates.”

This aligns with the central bank’s mandate from the government to maintain the Consumer Price Index (CPI) based retail inflation at 4 percent, with a 2 percent margin on either side.

The current policy stance reflects a significant shift from the aggressive rate hikes implemented between May 2022 and February 2023, during which the repo rate was raised by a cumulative 250 basis points.

Governor Das highlighted that while progress has been made towards durable inflation targets, optimism remains subject to potential shocks from weather conditions.

In his speech, Das outlined several key points. The RBI has maintained its FY25 real GDP growth projection at 7.2 percent year-on-year and CPI inflation at 4.5 percent.

He metaphorically described the current inflation situation, stating, “Inflation horse has been brought to the stable within the tolerance band. We have to be careful about opening the gate.”

The central bank also announced measures to enhance financial inclusivity and digital transactions. These include increasing the per-transaction limit in UPI 123Pay from Rs 5,000 to Rs 10,000 and raising the UPI Lite wallet limit from Rs 2,000 to Rs 5,000.

Additionally, banks and NBFCs are now prohibited from levying foreclosure charges or pre-penalties on loans to micro and small enterprises.

Das expressed concern over the rapid growth of some NBFCs, warning that aggressive expansion without robust underwriting practices could be problematic.

He suggested that self-correction by NBFCs would be preferable, but assured that the RBI is vigilant and prepared to intervene if necessary.

On a positive note, the Governor reported a turnaround in Foreign Portfolio Investment (FPI) flows, with inflows of USD 19.2 billion between June and October this year, compared to outflows of USD 4.2 billion previously.

He also noted that India’s foreign exchange reserves have surpassed the USD 700 billion milestone.

Looking ahead, Das cautioned that September’s retail inflation figures are likely to show a significant increase due to unfavourable base effects and rising food prices.

However, he expressed confidence in the overall moderation of inflation while acknowledging persistent risks. The RBI’s shift to a neutral stance reflects its assessment that growth and inflation are now well-balanced, marking an appropriate time for this policy adjustment.