New Delhi: The Reserve Bank of India (RBI) has unveiled a new mobile application that will allow retail investors to trade in various government securities, including central government bonds, state government bonds, and Treasury bills.

This move aims to provide greater convenience and deepen the government securities (G-sec) market.

Previously, retail investors could only access and invest in these government securities by logging onto the Retail Direct portal website. However, with the launch of this dedicated mobile app, investors can now buy and sell government securities on-the-go, at their convenience.

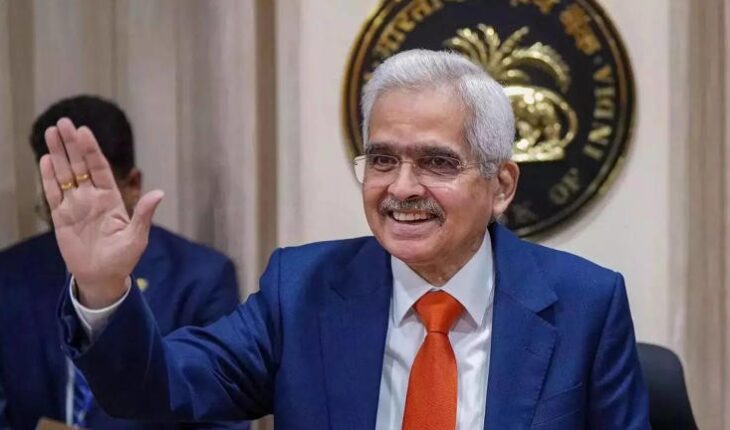

Commenting on the launch of the mobile app, RBI Governor Shaktikanta Das told the Economic Times, “The RBI Retail Direct Scheme was launched in November 2021. It is now proposed to launch a mobile app for accessing the Retail Direct portal.”

“This will be of greater convenience to retail investors and deepen the G-sec market,” he further added.

In a separate statement, the central bank provided further details about the app, stating, “RBI Retail Direct Scheme, launched in November 2021, gives access to individual investors to maintain gilt accounts with RBI and invest in government securities.”

The statement highlighted, “The Scheme enables investors to buy securities in primary auctions as well as buy/sell securities through the NDS-OM platform. To further improve ease of access, a mobile application for the Retail Direct portal is being developed.”

The statement also added, “The app will enable investors to buy and sell instruments on the go, at their convenience. The app will be available for use shortly.”

With the launch of this mobile app, the RBI aims to enhance the accessibility and participation of retail investors in the government securities market.