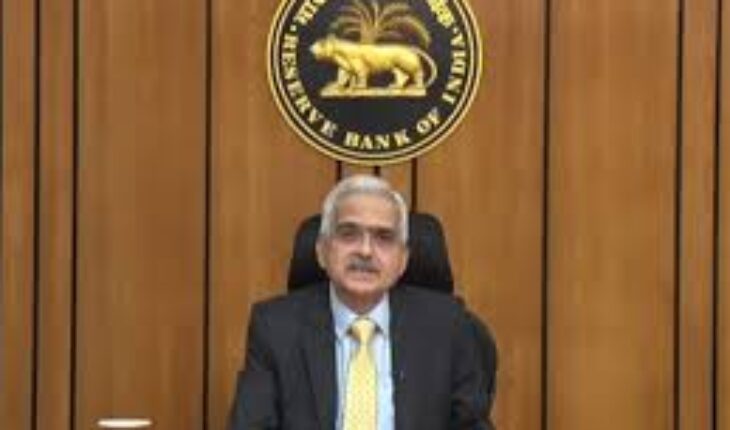

New Delhi: The Reserve Bank of India (RBI) Governor, Shaktikanta Das, announced in the bi-monthly monetary policy statement that the repo rate, the central bank’s rate for short-term loans to banks, will remain unchanged at 6.5 per cent. The decision reflects a cautious approach amid evolving economic conditions.

Governor Das highlighted that inflation and growth are currently balanced, but emphasised the need for vigilance concerning food prices.

In the Monetary Policy Committee (MPC) meeting, a majority of members voted to maintain the current rates, with four in favor and two against.

Governor Das indicated that while the overall inflation trajectory is moderating, vigilance is necessary. The RBI will maintain a flexible approach to liquidity management.

He underscored the resilience of the Indian financial system, which continues to gain strength from broader macroeconomic stability.

The Indian Rupee has remained largely stable in August. However, Das cautioned banks about potential structural liquidity issues due to declining deposits and raised concerns over the rising disbursals of top-up home loans, urging lenders to take corrective actions.

The Governor also noted that the Current Account Deficit is expected to remain manageable during this fiscal year. India’s forex reserves have reached a record high of USD 675 billion as of August 2.