Dr. Anil Kumar Angrish

Bhavishya Dumra

Pharmaceutical sector, with its substantial environmental footprint, finds itself at a pivotal moment in addressing sustainability challenges. Multiple ESG frameworks have been devised by various institutions and organizations to help investors, stakeholders, and companies understand and manage the risks and opportunities related to environmental, social, and governance aspects. Global Reporting Initiative (1997), Carbon Disclosure Project (2000), Equator Principles (2003), Principles for Responsible Investment (2006), ISO 26000 (2010), Sustainability Accounting Standards Board (2011), United Nations Sustainable Development Goals (UN SDG) (2015), and Business Reporting and Sustainability Reporting (BRSR) (2021) are prominent among these frameworks.

Emissions, in the context of Environmental Science, refer to the release of pollutants into the air. Scope 1 emissions are the most direct form of emissions which come from sources which are directly owned or controlled by an organization, e.g., natural gas used in the manufacturing process. Scope 2 emissions are the indirect emissions, e.g., emissions from the generation of purchased electricity, steam, heating, and cooling consumed. Scope 3 emissions are the most complex and far-reaching and are the result of activities of assets not owned or controlled by the reporting organization, and includes everything from the emissions produced by suppliers and product transportation to the emissions generated when customers use the organization’s products.

Table 1: Scope 3 Emissions

| 3.a. Upstream Scope 3 Emissions | 1. Purchased goods and services |

| 2. Capital goods | |

| 3. Fuel- and energy-related activities (not included in Scope 1 or Scope 2) | |

| 4. Upstream transportation and distribution | |

| 5. Waste generated in operations | |

| 6. Business travel | |

| 7. Employee commuting | |

| 8. Upstream leased assets | |

| 3.b. Downstream Scope 3 Emissions | 9. Downstream transportation and distribution |

| 10. Processing of sold products | |

| 11. Use of sold products | |

| 12. End-of-life treatment of sold products | |

| 13. Downstream leased assets | |

| 14. Franchises | |

| 15. Investments |

Source: Based on GRI 305: Emissions 2016 issued by the Global Sustainability Standards Board (2024)

From Table 1, one can understand that for some Scope 3 categories, emissions occur simultaneously with the activity, e.g., from combustion of energy, so emissions occur in the same year as the company’s activities. For some other categories, e.g., Capital goods, emissions may have occurred in previous years whereas for other Scope 3 categories, e.g., processing of sold products, emissions are expected to occur in future years. Table 2 gives an overview of the Time Boundary for Scope 3 Emission categories.

Table 2: Time Boundary for Scope 3 Emissions Categories

| Scope 3 Category | Past Years | Reporting Year | Future Years |

| Purchased goods and services | ✔ | ✔ | |

| Capital goods | ✔ | ✔ | |

| Fuel- and energy-related activities | ✔ | ✔ | |

| Upstream transportation and distribution | ✔ | ✔ | |

| Waste generated in operations | ✔ | ✔ | |

| Business travel | ✔ | ||

| Employee commuting | ✔ | ||

| Upstream leased assets | ✔ | ||

| Downstream transportation and distribution | ✔ | ✔ | |

| Processing of sold products | ✔ | ✔ | |

| Use of sold products | ✔ | ✔ | |

| End-of-life treatment of sold products | ✔ | ✔ | |

| Downstream leased assets | ✔ | ||

| Franchises | ✔ | ||

| Investments | ✔ | ✔ |

Source: Based on The GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard issued by World Resources Institute and the World Business Council for Sustainable Development.

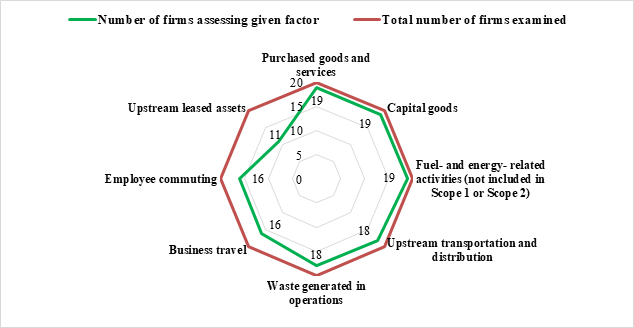

Top 20 global pharmaceutical MNCs namely J&J, AstraZeneca, GSK, Eli Lilly, Novo Nordisk, Amgen, Gilead Sciences, Bayer, Merck KGaA, and Teva Pharmaceuticals have demonstrated comprehensive reporting practices, assessing all eight upstream emission factors. Roche, Merck, Pfizer, Sanofi, Novartis, Bristol Myers Squibb, and Takeda report on most upstream factors, with some gaps indicating areas for improvement. Boehringer Ingelheim and Viatris are reporting 4 of 8 factors only whereas AbbVie does not report on any upstream emission factors.

Chart 1: Reporting on Upstream Scope 3 Emission Factors assessed by Global Pharma MNCs

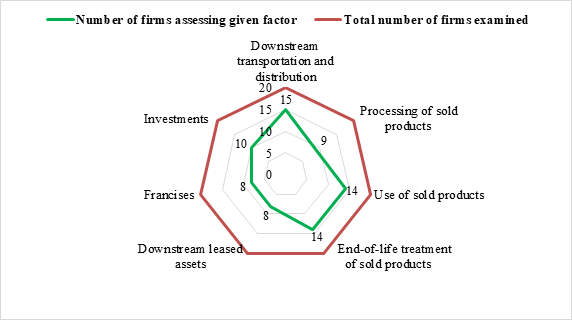

On Downstream Scope 3 emissions, global MNCs such as AstraZeneca, GSK, Eli Lilly, Amgen, Gilead Sciences, Bayer, Merck KGaA, and Teva Pharmaceuticals have a broad reporting scope, assessing nearly all downstream emission factors, demonstrating a proactive approach in managing their product lifecycle emissions. J&J, Pfizer, Merck, Sanofi, Novo Nordisk, and Takeda show moderate reporting practices, with some downstream factors assessed. AbbVie, Bristol Myers Squibb, Roche, Boehringer Ingelheim, and Viatris report on very few or none of the downstream factors, indicating limited engagement with the full lifecycle impacts of their products.

In case of top 20 global pharmaceutical MNCs, the extent of reporting varies significantly, indicating a lack of standardization and comprehensive disclosure across the industry. Upstream emission factors are more frequently reported than downstream factors. It is expected that these companies should give equal importance to downstream emissions to fully capture their environmental impact.

Chart 2: Reporting on Downstream Scope 3 Emission Factors assessed by Global Pharma MNCs

In contrast to this, on Upstream Scope 3 Emissions reporting in Annual Reports for FY23, top 20 pharmaceutical companies based on TSA Moving Annual Total (MAT) February 2024 values, in India exhibit less comprehensive reporting practices compared to their global counterparts. The list also includes subsidiaries of MNCs listed in India. This could be attributed to strict regulatory environment and higher stakeholder expectations in developed markets. Lupin Limited stands out for its comprehensive assessment of upstream emission factors, indicating a strong commitment to environmental transparency. Companies like Sun Pharma, Dr. Reddy’s Labs, and Glenmark report on several upstream factors, though not so extensively as their global counterparts do. Companies such as Zydus, Abbott India, Cipla, Mankind, Alkem, Torrent, GSK India, Pfizer India, Ipca Labs, and Sanofi India show minimal to no reporting on upstream emission factors, suggesting need for improved sustainability practices in their supply chains.

On Downstream Scope 3 Emissions, most of pharmaceutical companies in India do not report on downstream factors. Four Companies namely Sun Pharma, Lupin, Dr. Reddy’s Labs, and Glenmark have reported only one factor – Downstream transportation and distribution, out of seven Downstream Scope 3 Emission factors.

Enhanced reporting on Scope 3 Emissions by pharmaceutical companies in India will help in aligning with global best practices. Pharmaceutical companies which excel in this area can demonstrate leadership in sustainability that in turn, can enhance their reputation, meet regulatory requirements, and address the growing demands of stakeholders for transparency and accountability in environmental practices.

Dr. Anil Kumar Angrish, Associate Professor (Finance and Accounting),

Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Bhavishya Dumra, MBA (Pharm.), Department of Pharmaceutical Management,

NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.