Dr. Anil Kumar Angrish

Sabreen Azim Khan

Sustainable finance encompasses the investment process which integrates and encourages environment, and social considerations. Global Sustainable Finance market is projected to expand to US $23 trillion by 2031 (CII, 2023). Sustainable finance takes various forms such as ‘Green equities’ (Investments in shares of those companies or funds which promote positive environmental outcomes), ‘Green companies’ (Investment in those firms which advance environmental goals, e.g., renewable energy), ‘Green funds’ such as mutual funds or exchange-traded funds (ETFs) (investment in funds which focus on companies with positive environmental impact), or ‘Green debt’ (investment in debt instruments of those projects or companies which combat environmental degradation).

Earliest examples of Sustainable Investment include divestments from South Africa which were advocated as a protest against apartheid in 1970, and creation of the Pax World Fund in 1971, the first publicly available mutual fund in the USA which factored social and environmental criteria into investment decisions. In 1990, Amy Domini, the then Managing Director of KLD Research and Analytics developed the Domini 400 Social Index that focused on firms which prioritized social and environmental responsibility. Now, Domini 400 is called the MSCI KLD 400 Social Index. Many other initiatives such as United Nations Framework Convention on Climate Change (1992), Kyoto Protocol (1997), Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP) (2000), publication of ‘Who Cares Wins’ report with the term, ‘ESG’ (2004), Principles for Responsible Investment (2006). Besides these initiatives, most recent initiatives include E.U.’s Sustainable Finance Disclosure Regulation (2021), and EU’s Corporate Sustainability Reporting Directive (2023).

Essentially, a sustainable financial system involves creation of ‘frameworks’, ‘regulations’, and ‘practices’ which promote economic growth while addressing environmental, social, and governance (ESG) considerations.

In India, CRISIL – the prominent credit rating agency, Standard and Poor’s (S&P), K.L.D. Research & Analytics launched the S&P ESG India Index in 2008 which was the first investible index of Indian enterprises whose business strategies and performance demonstrated a high commitment to meet ESG standard. In 2009, guidelines issued by the Ministry of Corporate Affairs recommended that all businesses must develop CSR policies focusing around six core elements namely ‘care for stakeholders’, ‘proper functioning’, ‘respect for workers’ rights and welfare’, ‘respect for human rights’, ‘respect for the environment’, and ‘activities for social and inclusive development’.

In 2011, the Ministry of Corporate Affairs issued the National Voluntary Guidelines on Social, Environmental, and Economic responsibilities of Business. In 2012, the SEBI issued a circular mandated top listed companies to publish an annual business responsibility report. In 2014, companies of a particular scale and profitability were mandated to spend 2 per cent of their average profits of preceding three years on CSR activities. In 2017, IRDAI launched ‘Stewardship Code’ for Insurers. In 2018, Pension Fund Regulatory and Development Authority adopted the Stewardship Code. This reflected the participation of sectoral regulators in this movement. In recent years, many other initiatives have been taken in this regard such as Framework for Green Deposits by the RBI in April 2023, the SEBI Credit Rating Agencies (Amendment) Regulations in July 2023, Draft Green Credit Programme Implementation Rules in July 2023, introduction of the SEBI Sustainability Reporting Standards for a select group of listed companies, etc.

In addition to push by sectoral regulators, Sustainable Finance Industry in India is gaining traction due to multiple factors such as government backing as reflected in the National Green Hydrogen Mission, substantial renewable energy potential in India, growth in middle class with higher disposable income that is considered positive for sustainable investments, investment in sustainable infrastructure projects, etc. In this background, a Task Force on Sustainable Finance was established in January 2021 to define the ‘framework’, ‘pillars’, and ‘risk assessment for sustainable finance’. Key providers of sustainable finance to the corporate sector and Micro, Small and Medium Enterprises (MSMEs) include banks, corporations, institutional investors, international financial institutions, and international organizations through instruments such as Green Bonds, Impact Finance, Social Bonds, Microfinance, Climate Funds, the SIDBI Sustainable Finance Scheme, etc.

In recent years, investors have started increasingly prioritizing ESG factors in their investment decisions. It is observed from strong presence and investments of PE firms and Mutual Funds. Table 1 lists leading Sustainable Finance Investors namely, PE firms and mutual funds.

Table 1: – Leading Sustainable Finance Investors in India

| Sr. No. | Private Equity (PE) Firm | Mutual Funds |

| 1 | Premji Invest | SBI ESG Exclusionary Strategy Fund |

| 2 | Chrys Capital | Axis ESG Equity Fund |

| 3 | Kotak Private Equity | ICICI Prudential ESG Fund |

| 4 | True North’s India Value Fund | Kotak ESG Exclusionary Strategy Fund |

| 5 | ICICI Venture Fund – Private Equity | Aditya Birla Sun Life ESG Fund |

| 6 | Motilal Oswal Private Equity | Invesco India ESG Equity Fund |

| 7 | IDFC Private Equity Fund | Quant ESG Equity Fund |

| 8 | InvAscent | Nippon India ETF Nifty 100 ESG |

| 9 | CX Partners | Mirae Asset ESG Sector Leaders ETF |

| 10 | Tata Capital Fund | Quantum India ESG Equity Fund |

Source: Compiled from official websites of respective PE firms and Mutual Funds

Among leading domestic PE investors, Premji Invests (founded in 2006) has interests in Consumer discretionary/staples, Fintech, Enterprise, and Healthcare. Kotak PE (founded in 2005) has investments in Pharmaceuticals, Life sciences, Healthcare, Consumer, Technology and Financial Services. Firms in which investments have been made include Bharat Serums and Vaccines Limited, Narayana Health, Laurus Labs, among others. True North’s India Value Fund (founded in 1999) has investments in Healthcare, Consumer-focused industries like Media & Entertainment, Radio Taxi, Retailing, and Food Services, and Financial Services. ICICI Venture Fund – PE (founded in 1988) has interests in Financial Services, Insurance, Water, Media and Entertainment, Food, Quick Service Restaurants, Diagnostics, Healthcare, Biopharmaceuticals, Speciality Chemicals and Branded Apparel. Motilal Oswal PE (founded in 2006) has investments in Consumer, Financial Services, Life Sciences, and niche Manufacturing sectors. IDFC PE Fund (founded in 2002) has investments in Consumer, Healthcare, Food & Agriculture, Media & Telecom, Platforms, and Infrastructure and Industrial sector.

Most of these domestic PE firms have investments in Consumer-focused industries, financial services, fintech, life sciences, healthcare, and specialized manufacturing sectors. If we observe AUM of top ten global PE firms with investments in Sustainability initiatives and their investments in India-centric initiatives then we can find the significance of India as an ‘investment destination’ and one can gauge the ‘relative attractiveness’ of India, e.g., Insight Partners had investment in India to the tune of $1 Bn in comparison to their overall AUM of $90 Bn. For Thoma Bravo, it is $4.2 Bn out of $138 Bn, for CVC Capital, it is $6.8 Bn out of $212.3 Bn. The percentage is meagre if we look at top global PE firms. Hence, India has lot of potential to attract PE in Sustainability initiatives.

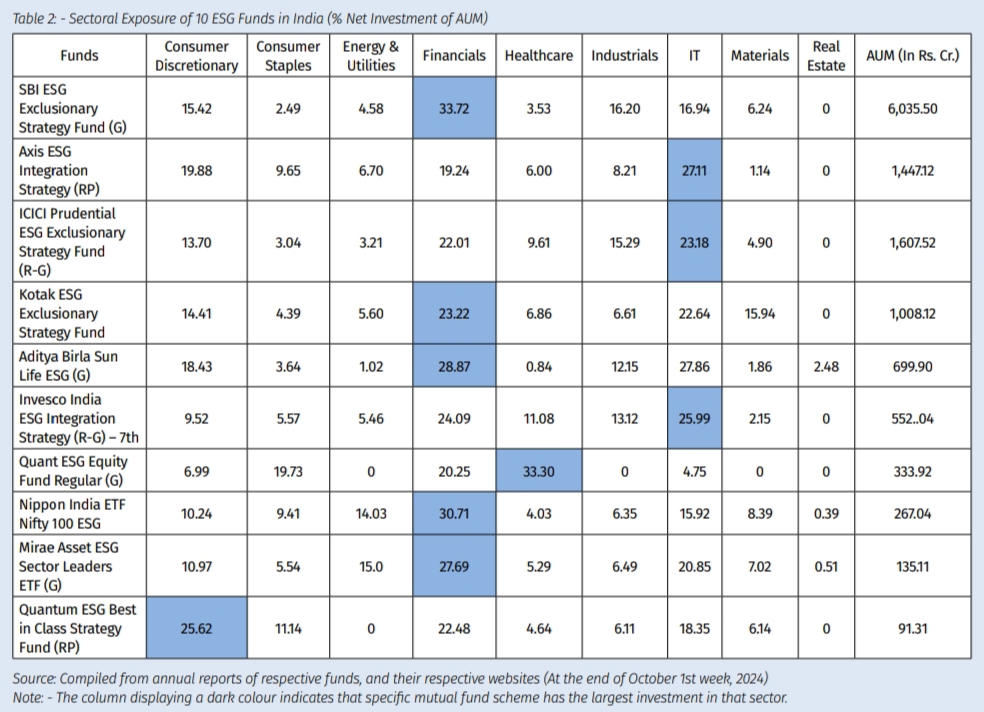

From Table 2, it can be concluded that majority of investments made by ESG Mutual Funds in India are in Financial Sector and Information Technology sector. Other sectors in which ESG funds have shown interest include Consumer Discretionary, Industrial, Energy and Utility, Consumer Staples, Materials, Healthcare and Real Estate sectors. It must be noted that total of all columns is not 100 per cent as the balancing figure is for ‘Cash and Cash equivalents’ as all funds do not remain invested, and liquidity is ensured for redemption as well. Three out of ten funds as listed in Table 2 have a small debt holding too in addition to equity, and Cash & Cash equivalents. BI ESG Exclusionary Strategy Fund had the highest Assets Under Management (AUM) of Rs. 6,035.50 Cr. In addition to this, Axis ESG Integration Strategy (Regular Plan), ICICI Prudential ESG Exclusionary Strategy Fund (Regular – Growth), and Kotak ESG Exclusionary Strategy Fund have AUM of more than Rs. 1,000 Crore each.

To keep this momentum, more PE firms and mutual funds need to foster partnerships and collaborations with players across different sectors. This can accelerate investment in sustainable projects across various industries, supporting innovation and responsible growth.

Dr. Anil Kumar Angrish- Associate Professor (Finance and Accounting), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Sabreen Azim Khan-MBA (Pharm.), Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab

Disclaimer: Views are personal and do not represent the views of the Institute.