In FY 2023-24, export of pharmaceuticals touched US $27.85 Bn from US $15.07 Bn in FY 2013-14. For April-December 2024, export of Drugs & Pharmaceuticals stood at US $21.67 Bn. Bain & Co. in a recent report that was published in collaboration with IDMA, IPA and Pharmaceuticals Export Promotion Council of India (Pharmexcil) stated that India is the 3rd largest nation in terms of pharma exports by volume (measured in thousands of tons) for the year 2023 with pharmaceutical exports of about 1,520 tons (in thousands) closely followed by the USA (about 1,510 thousand tons) and Germany (about 1,500 thousand tons). First and Second rank is occupied by China and France with 8,500 (thousand tons) and about 1,710 (thousand tons) respectively.

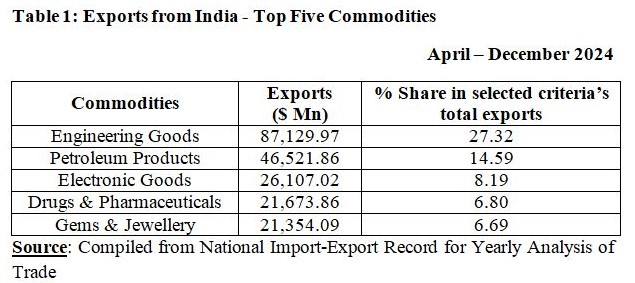

Drugs & Pharmaceuticals are the 4th largest commodity exports from India. Export of Drugs & Pharmaceuticals account for about 7 per cent of India’s total merchandise exports by value for April to Dec. 2024 period.

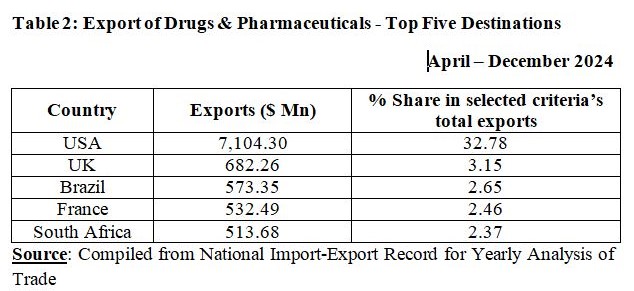

The USA alone forms about one-third of total export of drugs and pharmaceuticals from India. This reflects importance of the USA market for India. In a way, this shows the dependence of the USA on drugs & pharmaceuticals exported from India.

Due to exports of drugs & pharmaceuticals, if gainers are Indian pharmaceutical companies, then the same is the case for the U.S. economy. The Association for Accessible Medicines (AAM) which is a trade association that represents generic and biosimilar manufacturers released its 2024 U.S. Generic & Biosimilar Medicines Saving Report on September 5, 2024. The report revealed that due to use of approved generic and biosimilar medicines, there was savings to the tune of US $445 billion in the year 2023 alone for stakeholders including patients, employers, taxpayers, and the healthcare system. In past ten years, total generic & biosimilar savings amounted to more than US $3.1 Trillion. The role of generics and biosimilars can be gauged from the fact that generics & biosimilars represent 90 per cent of prescriptions filled in the U.S. but form only 13.1 per cent of prescription drug spending. Moreover, inflationary pressure is evident due to implementation of Inflation Reduction Act in the USA.

If tariffs are imposed at a higher rate, then medicines will become costlier, and ultimately, patients’ access to care will be adversely affected. Indirectly, the cost of healthcare will go up for patients. The National Health Statistics Group within Centers for Medicare & Medicaid Services of the USA conduct a comprehensive review & revision of the National Health Expenditure Accounts (NHEA) on five-yearly basis. The NHEA are the official estimates of total health care spending in the U.S. This data reflects that health spending accounted for 17.6 per cent of the Gross Domestic Product (GDP) of the U.S. economy. Further, the U.S. healthcare spending grew 7.5 per cent in 2023, with a total amount of US $4.9 trillion. This comes to approximately $14,570 per person.

One major concern for the U.S. may be India’s Goods Trade Surplus which has touched $35.33 Bn in FY24 as Exports from India during this period stood at US $77.52 Bn and Imports were to the tune of $42.19 Bn. In last five years, India’s Goods Trade Surplus has more than doubled as the surplus stood at $17.3 Bn in FY20, $22.75 Bn in FY21, $32.29 Bn in FY22, and $27.45 Bn in FY23.

Union Budget 2025-26 introduced cuts on Basic Customs Duty (BCD) on more than dozen items. 37 medicines and related 13 Patient Assistance Programs (PAPs) which were added in the list of items exempt from Basic Customs Duty (BCD) also benefited American pharmaceutical companies such as MSD Pharmaceuticals (known as Merck & Co., Inc., within the U.S. and Canada), Pfizer, Johnson & Johnson, and Bristol-Myers Squibb.

Many prominent Indian pharmaceutical companies have significant revenue from the U.S. market, e.g., Sun Pharma, the largest pharma company in India, was the 13th largest generics pharmaceutical company in the U.S. and held second position by prescriptions in the U.S. dermatology market in FY 24. In FY24, US business contributed 32 per cent to the company’s consolidated revenue. In Rupee terms, the company’s revenue in FY24, from the US market grew by 13.4 per cent Y-o-Y basis to reach ₹153,493 Million. By March 2024, Sun Pharma had 3 out of 27 Finished Dosage facilities and 1 out of 14 API facilities in the U.S. itself. This partially lowers the impact of tariff.

As per IQVIA MAT March 2024, Aurobindo Pharma is the largest generic pharma company in the US by Rx dispensed. In FY24, segment-wise contribution reflects that the U.S. market contributed 48 per cent to the total revenue of the company. Zydus Lifesciences is another prominent pharmaceutical company that is the 5th largest generic company in the USA and distributes over 200 generic products. In FY 2023-24, the company launched 28 generic products in the USA.

North America business of Cipla Limited had delivered the highest ever revenue of US $906 Mn in FY24. The North America core formulation business contributed 30 per cent of the company’s revenue. YoY growth was 24.0 per cent in FY 2023-24. Cipla has presence in the U.S. through Cipla USA Inc. (a wholly owned step-down subsidiary) that was certified as ‘Great Place to Work’ in the U.S., the recognition achieved by only generic company in the U.S. Cipla is part of a joint venture (JV) – MKC Biotherapeutics Inc., USA with the percentage stake owned by MNI Ventures, Cipla (EU) Limited and Kemwell Biopharma UK Limited in the ratio of 45.4 : 35.2 : 19.4. This purpose of this JV is to develop and commercialize novel cell therapy products for major unmet medical needs in the U.S. as well as in Japan and European Union (EU) regions. Such JVs de-risk any company from tariffs altogether when such products are manufactured and sold in any specific market.

By March 2024, Lupin was the 3rd largest pharmaceutical company in the U.S. by filled prescriptions, with a 5.2 per cent market share in generics. Lupin ranked as the 2nd largest generic pharmaceutical company by sales in the U.S. respiratory segment. In FY 2023-24, the U.S. market contributed to 34 per cent of the overall company’s sales. With a revenue of ₹67,628 million from the U.S. market, Lupin had 30 per cent growth over FY23. Moreover, the company has started focusing on complex generics as can be observed from the launch of Tiotropium (Gx Spiriva) in August 2023. It was the first Dry Powder Inhaler from India for the U.S. market.

For Torrent Pharma too, the USA is among top four markets with 10 per cent revenue coming from the US market in FY 2023-24. The breakup of revenues under key territories for FY 2022-23 shows that Torrent Pharma had 12 per cent of its revenue from the USA which fell by 7 per cent in FY 2023-24. The company earned 53 per cent of its revenue in FY 2023-24 from domestic market only. In absolute amount, Torrent Pharma earned ₹1,078 Crore from the US market in FY 2023-24, down from ₹1,162 Crore in FY 2022-23.

Indian pharmaceutical companies are likely gainers in near future too as the U.S. market is undergoing significant transformation. Due to impending losses of exclusivity, brand spending is likely to reduce by US $145 Bn over the five years from FY 2024-25. So, impact of tariff, if any, will get nullified in the medium-term.

Imposition of tariffs at a much higher rate, e.g., proposed rate of 25 per cent, will not be productive as pharmaceutical companies will pass it on to the customers only. Reciprocal tariff is not possible as product basket of American companies in India and Indian companies in the USA is entirely different. Even Dilip Shanghvi in a recent Summit held on February 15-16, 2023, expressed optimism that generic pharma products might be exempt from the tariffs as Sun Pharma supplies essential medications in the US market.

The U.S. market is the most important market for major Indian pharmaceutical companies given the fact that the U.S. pharma market is the largest globally in terms of dollar value – US $ 446 Bn in 2023 that had a CAGR of 5.3 per cent in previous five years. But branded medicines constitute a majority part of the market value. In comparison to that, unbranded generics dominate in terms of prescription volume. In that way, Indian pharmaceutical companies have advantage. Any tariff hike will be more negative for the U.S. patients, taxpayers, and the overall U.S. healthcare system.

Dr. Anil Kumar Angrish-Associate Professor (Finance and Accounting),Department of Pharmaceutical Management, NIPER S.A.S. Nagar (Mohali), Punjab.

Disclaimer: Views are personal and do not represent the views of the Institute.