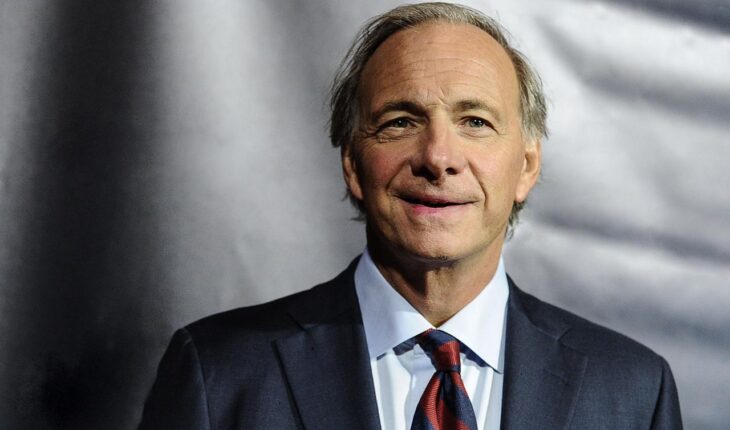

Mumbai : “PM Narendra Modi’s leadership highlights India’s potential and challenges prevalent in public markets including taxation, regulatory hurdles, and the specter of capital controls can often impede foreign investment flows,” according to Raymond T Dalio, Founder, CIO Mentor, and Member of the Bridgewater Board, Bridgewater Associates, LP.

However, to unlock growth potential, comprehensive development initiatives are necessary to streamline regulations, enhance efficiency, and foster a conducive investment environment, he said while addressing the “ET Now Global Business Summit 2024” organized in New Delhi recently.

Speaking on “Principles for Dealing with the Changing World Order,” Dalio highlighted how investors face a multitude of challenges and opportunities in today’s dynamic global environment and suggested ways to navigate through this changing world order.

Dalio, ranked the world’s 79th wealthiest person by Bloomberg in 2020, said “We delve into the statistical projections of growth rates, highlighting the rise of the middle class, increased capital formation, and opportunities for educational advancement.”

“These are the key factors that influence today’s economic progress. Notably, India has emerged as a standout performer on the world stage due to its significant developmental strides in recent years.”

However, he warned of potential challenges. “In the United States, the weakening of its currency status could trigger a ripple effect, which can lead to currency depreciation in other nations. High levels of debt pose a significant risk, urging investors to exercise caution, especially when dealing with bonds and heavily indebted assets,” he added.

Advocating diversification across various locations to mitigate risks, while also avoiding over-concentration in any single country or currency, he said “There are three critical factors to consider when evaluating investment prospects: a country’s ability to generate more income than expenditure, its internal competitiveness, and coherence amid external conflicts.”

Noting how development initiatives are needed to streamline regulations and enhance promising benefits for all stakeholders, he highlighted how climate change affects economics, while human inventiveness drives technological advancements.

Understanding these dynamics aid in making informed investment decisions in a changing world order, he added.

Bridgewater Associates is one of the largest hedge funds in the world and has helped in bringing about several changes in the financial sector through their understanding of the mechanics of credit and debt economics revolutionized investment strategies.